Christina Edling Melendi

Direct Phone: 212.705.7814

Direct Fax: 212.702.3624

christina.melendi@bingham.com

May 24, 2013

VIA EDGAR

Suzanne Hayes

Assistant Director

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Silvercrest Asset Management Group Inc.- PRO-FORMA FINANCIAL INFORMATION

Dear Ms. Hayes:

As previously discussed with the staff of the Division of Corporation Finance (the “Staff”), on behalf of our client, Silvercrest Asset Management Group Inc. (“Silvercrest” or the “Company”), we are submitting supplementally for the Staff’s review as Attachment A to this letter the following excerpted pages from the Company’s Registration Statement on Form S-1 (Registration No. 333-188005) with certain pro-forma financial information completed: (i) the cover page of the Prospectus, (ii) pages in the Summary Section related to post-offering capitalization and structure and the summary of the offering, (iii) the Use of Proceeds Section, (iv) the Capitalization Section, (v) the Dilution Section, (vi) the Selected Historical Consolidated Financial Data Section and (vii) the Unaudited Pro Forma Consolidated Financial Information Section.

Please direct any general questions or comments concerning the enclosed supplemental information, and any requests for additional information, to the undersigned at (212) 705-7814.

Sincerely yours,

/s/ Christina Edling Melendi

Christina Edling Melendi

cc: David J. Campbell (Silvercrest Asset Management Group Inc.)

Floyd I. Wittlin (Bingham McCutchen LLP)

David S. Huntington (Paul, Weiss, Rifkind, Wharton & Garrison LLP)

ATTACHMENT A

(See Attached)

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 22, 2013

PRELIMINARY PROSPECTUS

4,687,061 Shares

Silvercrest Asset Management Group Inc.

Class A Common Stock

This is an initial public offering of shares of Class A common stock of Silvercrest Asset Management Group Inc. We are offering, on a firm commitment basis, shares of Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. We expect the initial public offering price of our Class A common stock will be between $12.00 and $14.00 per share. We intend to apply to list our Class A common stock on The Nasdaq Global Market under the symbol “SAMG.”

We intend to use a portion of the net proceeds of this offering to purchase limited partnership units of our subsidiary Silvercrest L.P. from certain of its limited partners and will not retain any of these proceeds.

The underwriters have the option to purchase up to an additional 703,059 shares of our Class A common stock from us within 30 days of the date of this prospectus at the initial public offering price, less the underwriting discounts and commissions.

Prior to the consummation of this offering, we will issue 6,562,939 shares of our Class B common stock, each share of which initially entitles the holder to one vote per share, to the continuing limited partners of Silvercrest L.P. Of these Class B stockholders, holders of 6,440,199 shares of our Class B common stock, who will hold approximately 57.3% of the combined voting power of our common stock immediately after this offering (or approximately 53.9% if the underwriters exercise in full their option to purchase additional shares), will enter into a stockholders’ agreement pursuant to which they will agree to vote their shares of common stock together, as determined by the Executive Committee of Silvercrest L.P. whose vote will initially be controlled by our Chairman and Chief Executive Officer, on all matters submitted to a vote of our common stockholders.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 18.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to Silvercrest Asset Management Group Inc. |

$ | $ | ||||||

| (1) | The underwriters have reserved 234,353 shares for sale in a directed share program at the initial public offering price. We will pay reduced underwriting discounts and commissions in respect of shares sold in the directed share program. The table assumes that none of the shares reserved for sale in the directed share program are sold in the directed share program. If all of the shares reserved for sale in the directed share program are sold in the directed share program, the total underwriting discounts and commissions would be $0.2 million and the total proceeds to us, before expenses, would be $3.0 million. See “Underwriting” beginning on page 152 for a description of additional compensation received by the underwriters. |

Sandler O’Neill + Partners, L.P., on behalf of the underwriters, expects to deliver the shares of Class A common stock on or about , 2013, subject to customary closing conditions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| SANDLER O’NEILL + PARTNERS, L.P. | RAYMOND JAMES |

The date of this prospectus is , 2013.

| strategies decide to withdraw their investments or terminate their investment management agreements for any reason, our revenues from those strategies would decline, which would have a material adverse effect on our results of operations and financial condition. |

| • | Reduction in Our Growth Opportunities. As part of our growth strategy, we may seek to take advantage of opportunities to add new investment teams that invest in a way that is consistent with our philosophy of offering high value-added investment strategies. To the extent we are unable to recruit and retain investment teams that will complement our existing business model, we may not be successful in further diversifying our investment strategies and client assets, any of which could have a material adverse effect on our business and future prospects. |

Our Structure and Reorganization

On July 11, 2011, Silvercrest was incorporated as a Delaware corporation. Silvercrest GP LLC is currently the general partner of Silvercrest L.P., which is the managing member of the operating subsidiary, Silvercrest Asset Management Group LLC. See “The Reorganization and Our Holding Company Structure—Overview” for a description of the reorganization and the structure of our company. Prior to the consummation of this offering but after the effectiveness of the registration statement of which this prospectus forms a part, the members of Silvercrest GP LLC will receive a distribution of the general partner interests of Silvercrest L.P. owned by Silvercrest GP LLC as part of the reorganization. Once acquired, these interests that were distributed to the members of Silvercrest GP LLC will be automatically converted into limited partnership interests. Subsequent to the distribution of the general partner interests of Silvercrest L.P. to its members and the conversion of those interests into limited partnership interests, Silvercrest GP LLC will transfer its rights as general partner to Silvercrest and will be dissolved. Thereafter, Silvercrest will become the general partner of Silvercrest L.P. As part of the reorganization, the partnership agreement of Silvercrest L.P. will be amended to provide that the limited partnership interests will be converted to Class B units and the general partnership interests will be converted to Class A units.

Immediately following the reorganization, our only material asset will be the general partnership interests in Silvercrest L.P. We will use approximately $41.2 million of the net proceeds from this offering to purchase Class B units of Silvercrest L.P. from its current limited partners, including all Class B units held by Vulcan Wealth Management LLC, or Vulcan, and such Class B units acquired by us will be immediately converted into Class A units. Vulcan will therefore no longer hold any portion of Silvercrest L.P’s Class B units or any of our Class B common stock subsequent to the reorganization. Following the reorganization and this offering, we will own all of the Class A units, which represent the general partnership interest in Silvercrest L.P., or approximately 41.7% of the partnership units of Silvercrest L.P. (or approximately 45.1% of the partnership units if the underwriters exercise in full their option to purchase additional shares of Class A common stock). The remaining approximately 58.3% of the partnership units in Silvercrest L.P. (or 54.9% of the partnership units if the underwriters exercise in full their option to purchase additional shares of Class A common stock) will be held by 37 of our principals and two former employees, whom we refer to in this prospectus as the non-employee partners. We refer to our principals and non-employee partners collectively as our limited partners in this prospectus. In addition, Silvercrest L.P. has issued deferred equity units exercisable for 185,578 Class B units, which entitle the holders thereof to receive distributions from Silvercrest L.P. to the same extent as if the underlying Class B units were outstanding. See “The Reorganization and Our Holding Company Structure” for a description of the reorganization and the structure of our company. Prior to the consummation of this offering, Silvercrest L.P. intends to make a distribution to its limited partners in the aggregate amount of approximately $10.0 million. Purchasers in this offering will not be entitled to any portion of this distribution and such distribution may not be indicative of the amount of any future distributions.

7

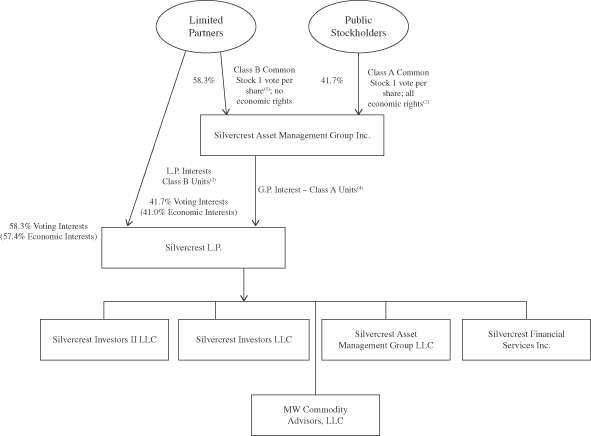

Set forth below is our holding company structure and anticipated ownership immediately after the consummation of this offering and the use of a portion of the net proceeds from this offering to purchase Class B units of Silvercrest L.P. from its limited partners including Vulcan (assuming no exercise of the underwriters’ option to purchase additional shares and without taking into account any outstanding deferred equity units).

| (1) | Each share of Class B common stock is entitled to one vote per share. Class B stockholders will have the right to receive the par value of the Class B common stock upon our liquidation, dissolution or winding-up. |

| (2) | Each share of Class A common stock is entitled to one vote per share. Class A common stockholders will have 100% of the rights of all classes of our capital stock to receive distributions, except that Class B common stockholders will have the right to receive the par value of the Class B common stock upon our liquidation, dissolution or winding-up. |

| (3) | Each Class B unit held by a principal is exchangeable for one share of Class A common stock. The limited partners will collectively hold 6,562,939 Class B units, which will represent the right to receive approximately 57.4% of the distributions made by Silvercrest L.P., and 185,578 non-voting deferred equity units exerciseable for Class B units, which will represent the right to receive approximately 1.6% of the distributions made by Silvercrest L.P. (or approximately 54.1% and 1.5%, respectively, of the distributions made by Silvercrest L.P. if the underwriters exercise in full their option to purchase additional shares of Class A common stock). The 185,578 deferred equity units which have been issued to limited partners of Silvercrest L.P. entitle the holders thereof to participate in distributions from Silvercrest L.P. as if the underlying Class B units are outstanding and thus are taken into account to determine the economic interest of each holder of units in Silvercrest L.P. However, because the Class B units underlying the deferred equity |

8

| units have not been issued and are not deemed outstanding, the holders of deferred equity units have no voting rights with respect to those Class B units. We will not issue shares of Class B common stock in respect of deferred equity units of Silvercrest L.P. until such time as the underlying Class B units are issued. |

| (4) | We will hold 4,687,061 Class A units (or 5,390,120 Class A units if the underwriters exercise in full their option to purchase additional shares of Class A common stock), which will represent the right to receive approximately 41.0% of the distributions made by Silvercrest L.P. (or approximately 44.4% of the distributions made by Silvercrest L.P. if the underwriters exercise in full their option to purchase additional shares of Class A common stock). The 185,578 deferred equity units which have been issued to principals of Silvercrest L.P. entitle the holders thereof to participate in distributions from Silvercrest L.P. as if the underlying Class B units are outstanding and thus are taken into account to determine the economic interest of each holder of units in Silvercrest L.P. However, because the Class B units underlying the deferred equity units have not been issued and are not deemed outstanding, the holders of deferred equity units have no voting rights with respect to those Class B units. We will not issue shares of Class B common stock in respect of deferred equity units of Silvercrest L.P. until such time as the underlying Class B units are issued. |

We are a Delaware corporation and the address of our principal executive offices is 1330 Avenue of the Americas, 38th Floor, New York, New York 10019. Our telephone number is (212) 649-0600 and our website is www.silvercrestgroup.com. Our website and the information included therein are not part of this prospectus.

9

The Offering

| Class A common stock offered by us |

4,687,061 shares of Class A common stock, or 5,390,120 shares of Class A common stock if the underwriters exercise in full their option to purchase additional shares. |

| Class A common stock to be outstanding immediately after this offering |

4,687,071 shares of Class A common stock (which includes 10 shares of Class A common stock issued to our Chairman and Chief Executive Officer on May 7, 2012), or 5,390,130 shares of Class A common stock if the underwriters exercise in full their option to purchase additional shares. If all outstanding Class B units of Silvercrest L.P. held by our principals were to be exchanged for shares of our Class A common stock, 11,250,010 shares of Class A common stock would be outstanding immediately after this offering. |

| Class B common stock to be outstanding immediately after this offering and the use of proceeds to purchase Class B units of Silvercrest L.P. |

6,562,939 shares of Class B common stock will be outstanding after this offering and the use of a portion of the net proceeds from this offering to purchase Class B units of Silvercrest L.P. from certain of its existing limited partners including Vulcan. See “Use of Proceeds.” Shares of our Class B common stock have voting rights but no economic rights (including no rights to dividends or distribution upon liquidation) and will be issued to our limited partners in an amount equal to the number of Class B units of Silvercrest L.P. that our limited partners hold following the reorganization (but will not be issued in respect of deferred equity units of Silvercrest L.P. held by our principals). When a Class B unit is purchased by us or exchanged for a share of Class A common stock, the corresponding share of Class B common stock will be cancelled. See “The Reorganization and Our Holding Company Structure—Second Amended and Restated Limited Partnership Agreement of Silvercrest L.P.—Coordination of Silvercrest Asset Management Group Inc. and Silvercrest L.P.” |

| Use of proceeds |

We will receive net proceeds from our sale of Class A common stock in this offering of approximately $56.4 million (or approximately $64.9 million if the underwriters exercise in full their option to purchase additional shares), based on an assumed initial public offering price of $13.00 per share (the midpoint in the price range set forth on the cover of this prospectus), in each case after deducting assumed underwriting discounts and estimated offering expenses payable by us. We intend to use approximately $41.2 million of the net proceeds from this offering to purchase 3,437,061 Class B units of Silvercrest L.P. from certain of its existing limited partners including Vulcan. The purchase price for the Class B units will be determined by the public offering price of our Class A common stock in this |

10

| offering, less the amount of underwriting discounts and commissions and offering expenses incurred by us on a per share basis. We intend to use the remaining net proceeds of this offering, including any proceeds from the exercise of the underwriters’ option to purchase additional shares, to purchase additional Class A units from Silvercrest L.P. and Silvercrest L.P. will use such proceeds for general corporate purposes, which may include business operations, investments in our business, the development of new investment strategies and strategic acquisitions. |

| Voting rights and stockholders’ agreement |

One vote per share for Class A common stock and Class B common stock. Our principals who hold shares of Class B common stock will enter into a stockholders’ agreement pursuant to which they will agree to vote, while employed by us, the shares of Class A common stock and Class B common stock that they hold in accordance with the decision of the Executive Committee of Silvercrest L.P., referred to herein as the Executive Committee, consisting as of the date hereof of G. Moffett Cochran, Chairman and Chief Executive Officer, Richard R. Hough III, President and Chief Operating Officer, Scott A. Gerard, Chief Financial Officer, David J. Campbell, General Counsel and Secretary, and Albert S. Messina, a Managing Director of our Portfolio Management Group. The vote of each member of the Executive Committee will be weighted based on the number of Class B units owned by the member relative to the number of Class B units held by all members of the Executive Committee at the time of a vote. Since Mr. Cochran, our Chief Executive Officer, owns a greater percentage of equity than the rest of the members of the Executive Committee collectively, he will initially control the vote of such committee, and, as a result, all of the shares of Class A common stock and Class B common stock held by our principals. See “The Reorganization and Our Holding Company Structure—Voting Rights of Class A and Class B Stockholders” and “The Reorganization and Our Holding Company Structure—Stockholders’ Agreement Among Class B Stockholders.” |

| Class B unit exchange |

Pursuant to the terms of the second amended and restated limited partnership agreement of Silvercrest L.P. and an exchange agreement to be entered into between us and the principals, each Class B unit held by a principal will be exchangeable for a share of our Class A common stock, subject to the exchange timing and volume limitations described under “The Reorganization and Our Holding Company Structure—Second Amended and Restated Limited Partnership Agreement of Silvercrest L.P.—Exchange Rights.” All Class B units held by a principal will be exchanged automatically for shares of our Class A common stock upon the termination of employment of such principal, other than in the case of retirement, subject to certain limitations described under “The Reorganization and Our Holding Company Structure—Second Amended and Restated Limited Partnership Agreement of Silvercrest L.P.—Exchange Rights.” |

11

| Resale and registration rights |

Pursuant to a resale and registration rights agreement that we will enter into with the principals, we will agree to use our best efforts to file a registration statement for the sale of the shares of our Class A common stock that are issuable upon exchange of Class B units as soon as practicable after we become eligible to file a registration statement on Form S-3, which we expect to be one year after the consummation of this offering. We expect to cause that registration statement to be declared effective by the Securities and Exchange Commission, or the SEC, as soon as practicable thereafter. See “The Reorganization and Our Holding Company Structure—Resale and Registration Rights Agreement” for a description of the timing and manner limitations on resales of these shares of our Class A common stock. |

| Dividend policy |

Upon completion of this offering, we will have no material assets other than our ownership of Class A units of Silvercrest L.P. Accordingly, our ability to pay dividends will depend on distributions from Silvercrest L.P. We intend to cause Silvercrest L.P. to make distributions to us with available cash generated from its subsidiaries’ operations in an amount sufficient to cover dividends. If Silvercrest L.P. makes such distributions, the limited partners will be entitled to receive equivalent distributions on a pro rata basis. |

| The declaration and payment of all future dividends, if any, will be at the sole discretion of our board of directors and may be discontinued at any time. In determining the amount of any future dividends, our board of directors will take into account any legal or contractual limitations, our actual and anticipated future earnings, cash flow, debt service and capital requirements and the amount of distributions to us from Silvercrest L.P. |

| Following this offering, we intend to pay quarterly cash dividends. See “Dividend Policy.” |

| Tax receivable agreement |

We will enter into a tax receivable agreement with the principals, and any future holders of Class B units, that will require us to pay them 85% of the amount of cash savings, if any, in U.S. federal, state and local income tax that we actually realize (or are deemed to realize in the case of an early termination payment by us, or a change in control) as a result of the increases in tax basis and certain other tax benefits related to entering into the tax receivable agreement, including tax benefits attributable to payments under the tax receivable agreement. This will be our obligation and not the obligation of Silvercrest L.P. We expect to benefit from the remaining 15% of cash savings, if any, realized. |

| The tax receivable agreement will commence upon consummation of this offering and will continue until all such tax benefits have been utilized or expired, unless we exercise our right to terminate the tax receivable agreement for an amount based on an agreed upon value of payments remaining to be made under the agreement. The tax receivable agreement will automatically terminate with respect to our obligations to a principal if a principal (i) is terminated for cause, (ii) breaches his or her non-solicitation covenants with our company or |

12

| (iii) voluntarily resigns or retires and competes with our company in the 12-month period following resignation of employment or retirement, and no further payments will be made to such principal under the tax receivable agreement. See “The Reorganization and Our Holding Company Structure—Tax Receivable Agreement.” |

| Listing symbol |

“SAMG.” |

Unless otherwise noted, the number of shares of Class A common stock outstanding after this offering and other information based thereon in this prospectus excludes:

| • | 4,687,071 shares of Class A common stock, which may be issued upon the exercise of the underwriters’ option to purchase additional shares; |

| • | 6,562,939 shares of Class A common stock reserved for issuance upon exchange of the Class B units that will be outstanding immediately after this offering; |

| • | 185,578 shares of Class A common stock reserved for issuance upon exchange of the corresponding number of Class B units reserved for issuance upon the exercise of deferred equity units that have been granted as of the date of this prospectus and 236,445 shares of Class A common stock reserved for issuance upon the vesting of performance units that have been granted as of the date of this prospectus; and |

| • | 1,687,500 shares of Class A common stock reserved for issuance under our new 2012 Equity Incentive Plan. |

13

Summary Selected Historical and Pro Forma Consolidated Financial Data

The following table sets forth the summary selected historical consolidated financial data of Silvercrest L.P., which is deemed to be our predecessor for accounting purposes, as of the dates and for the periods indicated. The historical selected consolidated statement of operations data for the years ended December 31, 2012, 2011 and 2010, and the consolidated statements of financial position data as of December 31, 2012 and 2011 of Silvercrest L.P. have been derived from, and are qualified in their entirety by, the historical audited consolidated financial statements of Silvercrest L.P. included elsewhere in this prospectus. The consolidated statements of financial position data as of December 31, 2010 have been derived from financial statements not included in this prospectus. The summary selected consolidated statements of operations data for the three months ended March 31, 2013 and 2012 and the summary selected consolidated statement of financial condition data as of March 31, 2013 have been derived from the Silvercrest L.P. unaudited condensed consolidated financial statements included elsewhere in this prospectus. The summary selected consolidated statement of financial condition data as of March 31, 2012 have been derived from the Silvercrest L.P. unaudited condensed consolidated statement of financial condition as of March 31, 2012, not included in this prospectus. These unaudited condensed consolidated financial statements have been prepared on substantially the same basis as our annual consolidated financial statements and include all adjustments that we consider necessary for a fair presentation of our results of operations and financial condition for the periods and as of the dates presented. Our results for the three months ended March 31, 2013 are not necessarily indicative of our results for a full fiscal year.

The unaudited pro forma consolidated financial data for Silvercrest Asset Management Group Inc. give effect to all transactions described under “Unaudited Pro Forma Consolidated Financial Information,” including the reorganization, the distribution of approximately $10.0 million to its existing limited partners prior to the consummation of this offering.

You should read the following summary selected historical consolidated financial data of Silvercrest L.P. and the unaudited pro forma financial information of Silvercrest, together with “Business,” “Selected Historical Consolidated Financial Data,” “Unaudited Pro Forma Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical consolidated financial statements and related notes of Silvercrest L.P. and subsidiaries appearing elsewhere in this prospectus. In the following tables (including the footnotes thereto), dollars are in thousands, except as otherwise indicated.

14

| Historical Silvercrest L.P. | Pro Forma Silvercrest | |||||||||||||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

Year Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2013 | 2012 | 2012 | 2013 | ||||||||||||||||||||||

| Statements of operations data: |

||||||||||||||||||||||||||||

| Revenue: |

||||||||||||||||||||||||||||

| Management and advisory fees |

$ | 46,069 | $ | 37,869 | $ | 32,442 | $ | 12,457 | $ | 10,682 | $ | 46,069 | $ | 12,457 | ||||||||||||||

| Performance fees and allocations |

714 | 85 | 548 | 3 | — | 714 | 3 | |||||||||||||||||||||

| Family office services |

4,907 | 4,833 | 3,841 | 1,225 | 1,198 | 4,907 | 1,225 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenue |

51,690 | 42,787 | 36,831 | 13,685 | 11,880 | 51,690 | 13,685 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Expenses: |

||||||||||||||||||||||||||||

| Compensation and benefits |

19,108 | 17,492 | 16,528 | 5,201 | 4,768 | 31,237 | 8,081 | |||||||||||||||||||||

| General and administrative |

13,680 | 10,849 | 9,459 | 2,710 | 2,566 | 13,680 | 2,710 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total expenses |

32,788 | 28,341 | 25,987 | 7,911 | 7,334 | 44,917 | 10,791 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income before other income (expense), net |

18,902 | 14,446 | 10,844 | 5,774 | 4,546 | 6,773 | 2,894 | |||||||||||||||||||||

| Other income (expense), net: |

||||||||||||||||||||||||||||

| Loss on forgiveness of notes receivable |

— | (34 | ) | (508 | ) | — | — | — | — | |||||||||||||||||||

| Other income (expense) |

123 | (210 | ) | 32 | 29 | 32 | 123 | 29 | ||||||||||||||||||||

| Interest income |

145 | 187 | 231 | 27 | 45 | 97 | 26 | |||||||||||||||||||||

| Interest expense |

(304 | ) | (164 | ) | (241 | ) | (37 | ) | (64 | ) | (304 | ) | (37 | ) | ||||||||||||||

| Equity income from investments |

1,911 | 950 | 1,241 | — | — | 1,911 | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total other income (expense), net |

1,875 | 729 | 755 | 19 | 13 | 1,827 | 18 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income before provision for income taxes |

20,777 | 15,175 | 11,599 | 5,793 | 4,559 | 8,600 | 2,912 | |||||||||||||||||||||

| (Provision) for income taxes |

(1,057 | ) | (566 | ) | (657 | ) | (329 | ) | (270 | ) | (2,108 | ) | (784 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

$ | 19,720 | $ | 14,609 | $ | 10,942 | $ | 5,464 | $ | 4,289 | 6,492 | 2,128 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income attributable to non-controlling interests |

(4,487 | ) | (1,525 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Net income attributable to Silvercrest |

$ | 2,005 | $ | 603 | ||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Selected statements of financial position data: |

||||||||||||||||||||||||||||

| Total assets |

$ | 52,454 | $ | 45,262 | $ | 33,079 | $ | 45,037 | $ | 40,454 | $ | 66,552 | ||||||||||||||||

| Notes payable |

3,315 | 4,809 | 2,957 | 4,350 | 4,362 | 4,350 | ||||||||||||||||||||||

| Total liabilities |

14,317 | 15,751 | 12,490 | 13,193 | 12,645 | 20,198 | ||||||||||||||||||||||

| Redeemable partners’ capital |

98,607 | 85,177 | 45,619 | 111,048 | 80,919 | — | ||||||||||||||||||||||

| Partners’ deficit/Stockholders’ equity |

(60,470 | ) | (55,666 | ) | (25,030 | ) | (79,204 | ) | (53,110 | ) | 67,876 | |||||||||||||||||

| Non-controlling interests |

— | — | — | — | — | (21,522 | ) | |||||||||||||||||||||

| Selected unaudited operating data: |

||||||||||||||||||||||||||||

| Assets under management (billions) (1) |

$ | 11.2 | $ | 10.1 | $ | 9.2 | $ | 13.6 | $ | 11.1 | ||||||||||||||||||

| Adjusted EBITDA (2) |

$ | 14,702 | $ | 10,839 | $ | 9,068 | $ | 4,137 | $ | 3,447 | ||||||||||||||||||

| Adjusted EBITDA margin (3) |

28.4 | % | 25.3 | % | 24.6 | % | 30.2 | % | 29.0 | % | ||||||||||||||||||

| (1) | As of the last day of the period. |

| (2) | To provide investors with additional insight, promote transparency and allow for a more comprehensive understanding of the information used by management in its financial and operational decision-making, we supplement our consolidated financial statements presented on a basis consistent with U.S. generally accepted accounting principles, or GAAP, with Adjusted EBITDA, a non-GAAP financial measure of earnings. EBITDA represents net income before income tax expense, interest income, interest expense, depreciation and amortization. We define Adjusted EBITDA as EBITDA without giving effect to professional fees associated with acquisitions or financing transactions, losses on forgiveness of notes receivable from our principals, gains on extinguishment of debt or other obligations related to acquisitions, impairment charges and losses on disposals or abandonment of assets and leaseholds, client reimbursements and fund redemption costs, severance and other similar expenses, but including partner incentive allocations as an expense. Our management uses Adjusted EBITDA as a financial measure to evaluate the profitability and efficiency of our business model. We use this non-GAAP financial measure to assess the strength of the underlying operations of our business. These adjustments, and the non-GAAP financial measure that is derived from them, provide supplemental information to analyze our operations between periods and over time. Investors should consider our non-GAAP financial measure in addition to, and not as a substitute for, financial measures prepared in accordance with GAAP. |

15

We estimate that the net proceeds from the sale of shares of our Class A common stock by us in this offering will be approximately $56.4 million (or approximately $64.9 million if the underwriters exercise in full their option to purchase additional shares), based on an assumed initial public offering price of $13.00 per share (the midpoint of the price range set forth on the cover of this prospectus), in each case after deducting assumed underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use approximately $41.2 million of the net proceeds from this offering to purchase an aggregate of 3,437,061 Class B units of Silvercrest L.P. from existing limited partners including Vulcan will not retain any of these proceeds. The purchase price for the Class B units will be determined by the public offering price of our Class A common stock in this offering less the per share amount of offering expenses incurred by us. We intend to use the remaining net proceeds of this offering, including any proceeds from the exercise of the underwriters’ option to purchase additional shares, to purchase additional Class A units from Silvercrest L.P. and Silvercrest L.P. will use such proceeds for general corporate purposes, which may include business operations, investments in our business and new investment strategies and strategic acquisitions for which no targets have been identified.

A $1.00 increase (decrease) in the assumed initial public offering price of $13.00 per share of our Class A common stock would increase (decrease) the amount of net proceeds to us from this offering available to purchase Class B units from our existing limited partners by approximately $4.7 million, and, as a result, the amount of proceeds available to us for general corporate purposes by approximately $4.7 million, assuming the number of shares of our Class A common stock offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

59

The following table sets forth our cash and cash equivalents and capitalization as of March 31, 2013 (1) on an actual basis for Silvercrest L.P. and (2) on a pro forma basis for Silvercrest after giving effect to the transactions described under “Unaudited Pro Forma Consolidated Financial Information,” including the reorganization and the application of the net proceeds from this offering (assuming no exercise of the underwriters’ option to purchase additional shares). The table below should be read in conjunction with “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the historical consolidated financial statements of Silvercrest L.P. and related notes included elsewhere in this prospectus.

| As of March 31, 2013 | ||||||||

| Silvercrest L.P. Actual |

Silvercrest Pro Forma | |||||||

| (unaudited) (dollars in thousands) |

||||||||

| Cash and cash equivalents (1) |

$ | 4,355 | $ | 9,745 | ||||

|

|

|

|

|

|||||

| Total long-term debt, including current portion |

4,350 | 4,350 | ||||||

|

|

|

|

|

|||||

| Total redeemable equity |

111,048 | — | ||||||

|

|

|

|

|

|||||

| Total (deficit) equity |

(79,204 | ) | 67,876 | |||||

|

|

|

|

|

|||||

| Total capitalization |

$ | 36,194 | $ | 72,226 | ||||

|

|

|

|

|

|||||

| (1) | Prior to the consummation of this offering, Silvercrest L.P. intends to make a distribution to its existing limited partners in the aggregate amount of approximately $10.0 million. Such distribution will be funded at the time of the reorganization but before the consummation of this offering. The pro forma effect of the reorganization and the offering on Cash and cash equivalents does not reflect the undistributed earnings and cash which we have accumulated subsequent to March 31, 2013. This distribution is reflected in the “Silvercrest Asset Management Group Inc. Consolidated Pro Forma” column of the Unaudited Pro Forma Consolidated Statement of Financial Condition as of March 31, 2013 included in “Unaudited Pro Forma Consolidated Financial Information” included elsewhere in this prospectus. |

62

If you invest in our Class A common stock, your interest will be diluted to the extent of the difference between the initial public offering price per share of our Class A common stock and the pro forma, as adjusted net tangible book value per share of our Class A common stock upon completion of this offering.

Our pro forma, as adjusted net tangible book value (deficit) as of March 31, 2013 was approximately $(12.2) million, or approximately $(1.1) per share of our Class A common stock. Pro forma, as adjusted net tangible book value per share represents the amount of total tangible assets less total liabilities, after giving effect to the reorganization and the distribution by Silvercrest L.P. to its pre-offering partners of some of its retained profits as of the date of the closing of this offering.

After giving effect to the sale by us of 4,687,061 shares of Class A common stock in this offering at the assumed initial public offering price of $13.00 per share (the midpoint of the price range set forth on the cover of this prospectus) after deducting assumed underwriting discounts and commissions and estimated offering expenses payable by us and the assumed exchange of all Class B units held by our principals that will be outstanding immediately after the reorganization for the corresponding number of shares of our Class A common stock, our pro forma as adjusted net tangible book value at March 31, 2013 was $14.5 million, or $1.28 per share of our Class A common stock. This represents an immediate increase in net tangible book value of $2.37 per share to our existing stockholders and an immediate dilution of $11.72 per share to the new investors purchasing shares in this offering. The following table illustrates this per share dilution:

| Assumed initial public offering price per share of Class A common stock |

$ | 13.00 | ||||||

| Pro forma, as adjusted net tangible book value per share of Class A common stock at March 31, 2013 |

$ | (1.09 | ) | |||||

| Increase in pro forma, as adjusted net tangible book value per share of Class A common stock attributable to new investors |

$ | 2.37 | ||||||

|

|

|

|||||||

| Pro forma, as adjusted net tangible book value per share after this offering |

$ | 1.28 | ||||||

|

|

|

|||||||

| Dilution in pro forma, as adjusted net tangible book value per share of Class A common stock to new investors |

$ | 11.72 | ||||||

|

|

|

The following table sets forth, on the same pro forma, as adjusted basis at March 31, 2013, the number of shares of Class A common stock purchased from us and the total consideration and the average price per share paid by existing equity holders, which consist of the principals, and by new investors purchasing Class A common stock in this offering, assuming that all principals who hold Class B units of Silvercrest L.P. immediately after the consummation of the reorganization have exchanged all their Class B units for the corresponding number of shares of our Class A common stock:

| Shares Purchased | Total Consideration | Average Price Per Share |

||||||||||||||||||

| Number | Percent | Amount | Percent | |||||||||||||||||

| Existing equity holders |

6,563 | 58.3 | % | $ | — | 0.0 | % | $ | — | |||||||||||

| New investors |

4,687 | 41.7 | 60,932 | 100.0 | 13.00 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

11,250 | 100.0 | % | $ | 60,932 | 100.0 | % | $ | 5.42 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

A $1.00 increase (decrease) in the assumed initial public offering price of $13.00 per share would increase (decrease) total consideration paid by new investors by $4.7 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and estimated offering expenses payable by us.

If the underwriters exercise in full their option to purchase additional shares, our pro forma as adjusted net tangible book value will increase to $1.93 per share, representing an increase to existing holders of $3.01 per share, and there will be an immediate dilution of $11.08 per share to new investors.

63

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

The following tables set forth selected historical combined consolidated financial and other data of Silvercrest L.P., which is deemed to be our predecessor for accounting purposes, as of the dates and for the periods indicated. As discussed elsewhere in this prospectus, Silvercrest L.P. was formed on December 10, 2008 and commenced operations on January 1, 2009. For reporting purposes, all balances of Silvercrest Asset Management Group LLC, the accounting predecessor to Silvercrest L.P., were carried over to Silvercrest L.P. at their carrying values on December 31, 2008. The selected consolidated statements of operations data for the years ended December 31, 2012, 2011 and 2010, and the consolidated statements of financial position data as of December 31, 2012 and 2011 have been derived from the Silvercrest L.P. and subsidiaries audited consolidated financial statements included elsewhere in this prospectus. The consolidated statement of operations data for the year ended December 31, 2009 and the consolidated statement of financial position data as of December 31, 2010 and 2009 has been derived from consolidated financial statements of Silvercrest L.P. and subsidiaries not included in this prospectus. The selected consolidated statements of operations data for the year ended December 31, 2008 and the consolidated statement of financial position data as of December 31, 2008 have been derived from the unaudited consolidated financial statements of Silvercrest Asset Management Group LLC and subsidiaries not included in this prospectus.

The selected consolidated statements of operations data for the three months ended March 31, 2013 and 2012 and the selected consolidated statements of financial condition data as of March 31, 2013 have been derived from the Silvercrest L.P. unaudited condensed consolidated financial statements included elsewhere in this prospectus. The summary selected consolidated statement of financial condition data as of March 31, 2012 have been derived from the Silvercrest L.P. unaudited condensed consolidated statement of financial condition as of March 31, 2012, not included in this prospectus. These unaudited condensed consolidated financial statements have been prepared on substantially the same basis as our annual consolidated financial statements and include all adjustments that we consider necessary for a fair presentation of our consolidated results of operations and financial condition for the periods and as of the date presented. Our results for the three months ended March 31, 2013 are not necessarily indicative of our results for a full fiscal year.

You should read the following selected historical consolidated financial data together with “The Reorganization and Our Holding Company Structure,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical combined consolidated financial statements and related notes included elsewhere in this prospectus. In the following table, dollars are in thousands, except assets under management which is in billions.

64

| Historical Silvercrest L.P. | Pro Forma Silvercrest | |||||||||||||||||||||||||||||||||||

| Years Ended December 31, | Three Months Ended March 31, |

Year Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 (1) | 2013 | 2012 | 2012 | 2013 | ||||||||||||||||||||||||||||

| Statements of operations data: |

||||||||||||||||||||||||||||||||||||

| Revenue: |

||||||||||||||||||||||||||||||||||||

| Management and advisory fees |

$ | 46,069 | $ | 37,869 | $ | 32,442 | $ | 29,341 | $ | 40,987 | $ | 12,457 | $ | 10,682 | $ | 46,069 | $ | 12,457 | ||||||||||||||||||

| Performance fees and allocations |

714 | 85 | 548 | 96 | 75 | 3 | — | 714 | 3 | |||||||||||||||||||||||||||

| Family office services |

4,907 | 4,833 | 3,841 | 3,097 | 2,019 | 1,225 | 1,198 | 4,907 | 1,225 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total revenue |

51,690 | 42,787 | 36,831 | 32,534 | 43,081 | 13,685 | 11,880 | 51,690 | 13,685 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Expenses: |

||||||||||||||||||||||||||||||||||||

| Compensation and benefits |

19,108 | 17,492 | 16,528 | 15,630 | 18,399 | 5,201 | 4,768 | 31,237 | 8,081 | |||||||||||||||||||||||||||

| General and administrative |

13,680 | 10,849 | 9,459 | 13,006 | 11,943 | 2,710 | 2,566 | 13,680 | 2,710 | |||||||||||||||||||||||||||

| Impairment charges |

— | — | — | 1,691 | 9,599 | — | — | — | — | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total expenses |

32,788 | 28,341 | 25,987 | 30,327 | 39,941 | 7,911 | 7,334 | 44,917 | 10,791 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income before other income (expense), net |

18,902 | 14,446 | 10,844 | 2,207 | 3,140 | 5,774 | 4,546 | 6,773 | 2,894 | |||||||||||||||||||||||||||

| Other income (expense), net: |

||||||||||||||||||||||||||||||||||||

| Gain on extinguishment of debt |

— | — | — | 3,934 | — | — | — | — | — | |||||||||||||||||||||||||||

| Gain on settlement with former Long Champ shareholders |

— | — | — | 1,470 | — | — | — | — | — | |||||||||||||||||||||||||||

| Loss on forgiveness of notes receivable |

— | (34 | ) | (508 | ) | — | — | — | — | — | — | |||||||||||||||||||||||||

| Other income (expense) |

123 | (210 | ) | 32 | — | — | 29 | 32 | 123 | 29 | ||||||||||||||||||||||||||

| Interest income |

145 | 187 | 231 | 213 | 358 | 27 | 45 | 97 | 26 | |||||||||||||||||||||||||||

| Interest expense |

(304 | ) | (164 | ) | (241 | ) | (467 | ) | (613 | ) | (37 | ) | (64 | ) | (304 | ) | (37 | ) | ||||||||||||||||||

| Change in value of options granted to equity holders |

— | — | — | 134 | 796 | — | — | — | — | |||||||||||||||||||||||||||

| Equity income (loss) from investments |

1,911 | 950 | 1,241 | 274 | (247 | ) | — | — | 1,911 | — | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total other income (expense), net |

1,875 | 729 | 755 | 5,558 | 294 | 19 | 13 | 1,827 | 18 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income before (provision) benefit for income taxes |

20,777 | 15,175 | 11,599 | 7,765 | 3,434 | 5,793 | 4,559 | 8,600 | 2,912 | |||||||||||||||||||||||||||

| (Provision) benefit for income taxes |

(1,057 | ) | (566 | ) | (657 | ) | 321 | (1,062 | ) | (329 | ) | (270 | ) | (2,108 | ) | (784 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income |

$ | 19,720 | $ | 14,609 | $ | 10,942 | $ | 8,086 | $ | 2,372 | $ | 5,464 | $ | 4,289 | 6,492 | 2,128 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Net income attributable to non-controlling interests |

(4,487 | ) | (1,525 | ) | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||

| Net income attributable to Silvercrest |

$ | 2,005 | $ | 603 | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||

| Selected statements of financial position data: |

||||||||||||||||||||||||||||||||||||

| Total assets |

$ | 52,454 | $ | 45,262 | $ | 33,079 | $ | 29,964 | $ | 37,719 | $ | 45,037 | $ | 40,454 | $ | 66,552 | ||||||||||||||||||||

| Notes payable |

3,315 | 4,809 | 2,957 | 7,120 | 8,855 | 4,350 | 4,362 | 4,350 | ||||||||||||||||||||||||||||

| Total liabilities |

14,317 | 15,751 | 12,490 | 14,893 | 23,282 | 13,193 | 12,645 | 20,198 | ||||||||||||||||||||||||||||

| Redeemable partners’/members’ capital |

98,607 | 85,177 | 45,619 | 34,219 | 83,377 | 111,048 | 80,919 | — | ||||||||||||||||||||||||||||

| Partners’/members’ deficit/Stockholders’ equity |

(60,470 | ) | (55,666 | ) | (25,030 | ) | (19,148 | ) | (68,940 | ) | (79,204 | ) | (53,110 | ) | 67,876 | |||||||||||||||||||||

| Non-controlling interests |

— | — | — | — | — | — | — | (21,522 | ) | |||||||||||||||||||||||||||

| Selected unaudited operating data: |

||||||||||||||||||||||||||||||||||||

| Assets under management (in billions) (2) |

$ | 11.2 | $ | 10.1 | $ | 9.2 | $ | 8.8 | $ | 7.8 | $ | 13.6 | $ | 11.1 | ||||||||||||||||||||||

| Adjusted EBITDA (3) |

$ | 14,702 | $ | 10,839 | $ | 9,068 | $ | 6,499 | $ | 7,107 | $ | 4,137 | $ | 3,447 | ||||||||||||||||||||||

| Adjusted EBITDA margin (4) |

28.4 | % | 25.3 | % | 24.6 | % | 20.0 | % | 16.5 | % | 30.2 | % | 29.0 | % | ||||||||||||||||||||||

| (1) | Effective January 1, 2009, each of the members of Silvercrest Asset Management Group LLC, or SAMG LLC, contributed their limited liability company interests in SAMG LLC to Silvercrest L.P. in return for limited partnership interests in Silvercrest L.P., and membership interests in Silvercrest GP LLC. As a result of the reorganization SAMG LLC became a wholly owned subsidiary of Silvercrest L.P. The reorganization was accounted for as a transaction between entities under common control. |

| (2) | As of the last day of the period. |

| (3) | To provide investors with additional insight, promote transparency and allow for a more comprehensive understanding of the information used by management in its financial and operational decision-making, we supplement our consolidated financial statements presented on a GAAP basis with Adjusted EBITDA, a non-GAAP financial measure of earnings. EBITDA represents net income before income tax expense, interest income, interest expense, depreciation and amortization. We define Adjusted EBITDA as EBITDA without giving effect to professional fees associated with acquisitions or financing transactions, losses on forgiveness of notes receivable from our principals, gains on extinguishment of debt or other obligations related to acquisitions, impairment charges and losses on disposals or abandonment of assets and leaseholds, client reimbursements and fund redemption costs, severance and other similar expenses, but including partner incentive allocations as an expense. Our management uses Adjusted EBITDA as a financial measure to evaluate the profitability and efficiency of our business model. We use this non-GAAP financial measure to assess the strength of the underlying operations of our business. These adjustments, and the non-GAAP financial |

65

UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

The following unaudited consolidated pro forma financial statements present the consolidated results of operations and financial condition of Silvercrest and its predecessor, Silvercrest L.P., assuming that all of the transactions described in the three bullet points below had been completed as of January 1, 2012 with respect to the unaudited pro forma consolidated statement of operations data for the year ended December 31, 2012, and for the three months ended March 31, 2013, respectively, and as of March 31, 2013, with respect to the unaudited pro forma consolidated statement of financial condition data as of March 31, 2013. The pro forma adjustments are based on available information and upon assumptions that our management believes are reasonable in order to reflect, on a pro forma basis, the impact of these transactions and this offering on the historical financial information of Silvercrest L.P.

The pro forma adjustments principally give effect to the following transactions:

| • | the reorganization described in “The Reorganization and Our Holding Company Structure,” which will occur prior to the consummation of this offering, including our agreement to return 85% of the tax benefits that we receive as a result of our ability to step up our tax basis in the partnership units of Silvercrest L.P. that we acquire from our partners and including the distribution by Silvercrest L.P. of approximately $10.0 million to its existing partners prior to the consummation of this offering; |

| • | the amendment of the partnership agreement of Silvercrest L.P., effective as of the consummation of this offering, to eliminate the call and put rights of Silvercrest L.P. and its partners, respectively upon a partner’s death, or, if applicable, termination of employment, which required all partnership units to be classified as temporary equity in Silvercrest L.P.’s consolidated financial statements; and |

| • | the sale of shares of our Class A common stock in this offering at an assumed offering price of $13.00 per share (the midpoint of the price range set forth on the cover of this prospectus) and the application of the proceeds therefrom, after payment of assumed underwriting discounts and commissions and estimated offering expenses payable by us (assuming no exercise of the underwriters’ option to purchase additional shares). |

The unaudited consolidated pro forma financial information of Silvercrest and its predecessor should be read together with “The Reorganization and Our Holding Company Structure,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical consolidated financial statements of Silvercrest L.P. and related notes included elsewhere in this prospectus.

The unaudited consolidated pro forma financial information is included for informational purposes only and does not purport to reflect our results of operations or financial condition that would have occurred had we operated as a public company during the periods presented. The unaudited consolidated pro forma financial information should not be relied upon as being indicative of our results of operations or financial condition had the transactions contemplated in connection with the reorganization and this offering been completed on the dates assumed. The unaudited consolidated pro forma financial information also does not project the results of operations or financial condition for any future period or date.

All dollar amounts in the following unaudited consolidated pro forma financial information are presented in thousands, except for per share amounts and except as otherwise indicated.

68

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE YEAR DECEMBER 31, 2012

| Silvercrest L.P. Historical |

Reorganization Adjustments (1) |

Reorganization Adjustment Pro Forma Note |

As Adjusted Before Offering |

Offering Adjustments (2) |

Offering Adjustments Pro Forma Note |

Silvercrest Asset Management Group Inc. Consolidated Pro Forma |

||||||||||||||||||||||

| Revenue: |

||||||||||||||||||||||||||||

| Management and advisory fees |

$ | 46,069 | $ | — | $ | 46,069 | $ | — | $ | 46,069 | ||||||||||||||||||

| Performance fees and allocations |

714 | — | 714 | — | 714 | |||||||||||||||||||||||

| Family office services |

4,907 | — | 4,907 | — | 4,907 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total revenue |

51,690 | — | 51,690 | — | 51,690 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Expenses: |

||||||||||||||||||||||||||||

| Compensation and benefits |

19,108 | 12,129 | (A | ) | 31,327 | — | 31,237 | |||||||||||||||||||||

| General and administrative |

13,680 | — | 13,680 | — | 13,680 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total expenses |

32,788 | 12,129 | 44,917 | — | 44,917 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income before other income (expenses) |

18,902 | (12,129 | ) | 6,773 | — | 6,773 | ||||||||||||||||||||||

| Other income (expense): |

||||||||||||||||||||||||||||

| Other income |

123 | — | 123 | — | 123 | |||||||||||||||||||||||

| Interest income |

145 | (48 | ) | (B | ) | 97 | — | 97 | ||||||||||||||||||||

| Interest expense |

(304 | ) | — | (304 | ) | — | (304 | ) | ||||||||||||||||||||

| Equity income from investments |

1,911 | — | 1,911 | — | 1,911 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total other income |

1,875 | (48 | ) | 1,827 | — | 1,827 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income before provision for income taxes |

20,777 | (12,177 | ) | 8,600 | — | 8,600 | ||||||||||||||||||||||

| Provision for income taxes |

(1,057 | ) | — | (1,057 | ) | (1,051 | ) | (A | ) | (2,108 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income (excluding non-recurring charges) |

19,720 | (12,177 | ) | 7,543 | (1,051 | ) | 6,492 | |||||||||||||||||||||

| Less: net income attributable to non-controlling interests |

— | — | — | (4,487 | ) | (B | ) | (4,487 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income attributable to Silvercrest |

$ | 19,720 | $ | (12,177 | ) | $ | 7,543 | $ | (5,538 | ) | $ | 2,005 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income per share: |

||||||||||||||||||||||||||||

| Basic |

(C | ) | $ | 0.38 | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Diluted |

(C | ) | $ | 0.38 | ||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||||||||||

| Basic |

(C | ) | 5,302,054 | |||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Diluted |

(C | ) | 5,302,054 | |||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| (1) | Reorganization Adjustments: |

(A) Reflects the adjustment to treat our historical partner incentive payments of $12,129, which were recorded as distributions when paid prior to this offering, as compensation expense.

69

(B) Reflects an adjustment to eliminate interest income earned on the partner notes receivable from named executive officers as if such notes had been repaid January 1, 2012. Such notes were repaid on September 18, 2012 and April 17, 2013.

| (2) | Offering Adjustments: |

(A) Reflects the impact of federal, state and local income taxes on the income of Silvercrest. The pro forma effective income tax rate is estimated to be approximately 24.5% and was determined by combining the projected federal, state and local income taxes.

Historically, as a flow through entity, Silvercrest L.P. has not been subject to U.S. federal and certain state income taxes, however it has been subject to the New York City Unincorporated Business Tax. As a result of our reorganization, we will become subject to U.S. federal and certain state income taxes applicable to C-Corporations. The provision for income taxes differs from the amount of income tax computed by applying the applicable U.S. statutory federal income tax rate to income before provision for income taxes as follows:

| For the Year Ended December 31, 2012 |

||||||||

| (dollars in thousands) |

||||||||

| Provision at federal statutory rate |

$ | 3,010 | 35.0 | % | ||||

| State and local income taxes, net of federal |

1,266 | 14.7 | % | |||||

| Other permanent items |

(25 | ) | (0.3 | )% | ||||

| Rate benefit from the flow through entity (1) |

2,143 | (24.9 | )% | |||||

|

|

|

|

|

|||||

| Provision for income taxes |

$ | 2,108 | 24.5 | % | ||||

|

|

|

|

|

|||||

| (1) | Rate benefit from the flow through entity is calculated principally by multiplying the consolidated pro forma income before tax by the percentage of non-controlling interests (59.5%) represented by the Class B units and deferred equity units of Silvercrest L.P. and the federal and state statutory rates. The pro forma income before tax attributable to the non-controlling interests would be subject to New York City Unincorporated Business tax at the consolidated level at a statutory rate of 4.0%. The federal and state income taxes on the earnings attributable to the Class B units and deferred equity units will be payable directly by the principals of Silvercrest L.P. who hold such units. |

The table above includes certain book to tax differences such as losses recorded on sub-leases and meals and entertainment which represent permanent differences. These differences are recognized at the level of the flow through entity, Silvercrest L.P., which indirectly benefit Silvercrest by reducing the effective income tax rate.

(B) Represents the non-controlling interest allocation of 59.5% (assuming no exercise of the underwriters’ option to purchase additional shares) of the net income of Silvercrest to Silvercrest L.P. The percentage is based on the Class B units of Silvercrest L.P. to be outstanding after the offering and the unvested deferred equity units (which share in Silvercrest L.P.’s earnings as if vested). All unit amounts set forth below give effect to the unit distribution to be made to the existing limited partners of Silvercrest L.P. subsequent to the effectiveness of the registration statement of which this prospectus forms a part in connection with the reorganization. The percentage of ownership interests (including deferred equity units) held by each existing limited partner will not be changed by the unit distribution. The pro forma effect of the unit distribution if it had occurred as of December 31, 2012 would result in 18.65 units being outstanding after the distribution for each one unit outstanding prior to the distribution (including deferred equity units).

The elimination of the put and call rights associated with the existing limited partnership units of Silvercrest L.P. that will occur as part of the reorganization results in a modification of the terms of the deferred equity units.

70

Such modification will not result in an increase in the fair value of the deferred equity units and therefore no incremental compensation charge is required to be reflected in the pro forma consolidated statement of operations.

| (dollars in thousands) |

Units Outstanding Excluding Deferred Equity Units |

Units Outstanding Including Deferred Equity Units |

||||||

| Class B units to be outstanding |

6,562,939 | 6,562,939 | ||||||

| Outstanding deferred equity units at December 31, 2012 |

— | 319,030 | ||||||

|

|

|

|

|

|||||

| Total units attributable to non-controlling interest |

6,562,939 | 6,881,969 | ||||||

| Total units to be outstanding |

11,250,010 | 11,569,040 | ||||||

| Non-controlling interest allocation |

58.3 | % | 59.5 | % | ||||

| Income before provision for income taxes |

$ | 8,600 | ||||||

| Non-controlling interest allocation |

59.5 | % | ||||||

| Non-controlling interest income before provision for income taxes |

5,116 | |||||||

| Non-controlling portion of provision for income taxes (1) |

(629 | ) | ||||||

|

|

|

|||||||

| Net income attributable to non-controlling interests |

$ | 4,487 | ||||||

|

|

|

|||||||

| (1) | The non-controlling portion of provision for income taxes of ($629) for the period ended December 31, 2012, is calculated by multiplying the pro forma provision for income taxes for Silvercrest L.P. of ($1,057) by the non-controlling interest allocation percentage of 59.5%. |

(C) Calculation of Earnings per Class A Share

For purposes of calculating the pro forma net income per Class A share, the number of Class A shares of Silvercrest outstanding are calculated as follows:

| Incremental shares of Class A common stock (1) |

614,983 | |||

| Shares of Class A common stock outstanding immediately after this offering |

4,687,071 | |||

|

|

|

|||

| Total pro forma Class A shares of Silvercrest for purposes of calculating pro forma net income per Class A share |

5,302,054 | |||

|

|

|

| (1) | Represents incremental Class A shares whose proceeds are assumed to fund the cash distribution to our existing principals as such distribution exceeds current year pro forma earnings. |

| Distribution prior to offering |

$ | 10,000,000 | ||

| Pro forma net income attributable to Silvercrest |

$2,005,220 | |||

|

|

|

|||

| Distribution in excess of pro forma net income attributable to Silvercrest |

$ | 7,994,780 | ||

| Initial public offering price per share |

$ | 13.00 | ||

|

|

|

|||

| Incremental shares of Class A common stock |

614,983 | |||

| Shares of Class A common stock outstanding immediately after this offering |

4,687,071 | |||

|

|

|

|||

| Total pro forma Class A shares of Silvercrest for purposes of calculating pro forma net income per Class A share |

5,302,054 | |||

|

|

|

The pro forma basic and diluted net income per Class A share is calculated as follows (Dollars in thousands, except per share data):

| Basic | Diluted | |||||||

| Pro forma net income attributable to Silvercrest (2) |

$ | 2,005 | $ | 2,005 | ||||

| Weighted average common shares outstanding |

5,302,054 | 5,302,054 | ||||||

|

|

|

|

|

|||||

| Pro forma net income per Class A share |

$ | 0.38 | $ | 0.38 | ||||

|

|

|

|

|

|||||

| (2) | Our shares of Class B common stock do not share in our earnings and are therefore not included in the weighted average shares outstanding or net income per share. Furthermore, no pro forma effect was given to |

71

| the future potential exchanges of the 6,562,939 Class B units of Silvercrest L.P. held by our principals that will be outstanding immediately after the consummation of the reorganization and the offering for a corresponding number of shares of our Class A common stock because the issuance of shares of Class A common stock upon these exchanges would not be dilutive. |

Employee bonuses and related payroll taxes of $932 are expected to be paid in conjunction with the completion of this offering but have not been reflected in the unaudited pro forma statement of operations given the non-recurring nature of these payments.

72

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF FINANCIAL CONDITION

AS OF MARCH 31, 2013

| Silvercrest L.P. Historical |

Reorganization Adjustments (1) |

Reorganization Adjustment Pro Forma Note |

As Adjusted Before Offering |

Offering Adjustments (2) |

Offering Adjustments Pro Forma Note |

Silvercrest Asset Management Group Inc. Consolidated Pro Forma |

||||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 4,355 | $ | 167 | (A | ) | $ | 4,522 | $ | 60,392 | (A | ) | $ | 9,745 | ||||||||||||||

| (3,961 | ) | (A | ) | |||||||||||||||||||||||||

| (615 | ) | (A | ) | |||||||||||||||||||||||||

| (41,162 | ) | (A | ) | |||||||||||||||||||||||||

| 30 | (A | ) | ||||||||||||||||||||||||||

| (10,000 | ) | (A | ) | |||||||||||||||||||||||||

| Restricted certificates of deposit and escrow |

1,275 | — | 1,275 | — | 1,275 | |||||||||||||||||||||||

| Investments |

84 | — | 84 | — | 84 | |||||||||||||||||||||||

| Receivables, net |

3,307 | — | 3,307 | — | 3,307 | |||||||||||||||||||||||

| Due from Silvercrest Funds |

1,220 | — | 1,220 | — | 1,220 | |||||||||||||||||||||||

| Furniture, equipment and leasehold improvements, net |

1,990 | — | 1,990 | — | 1,990 | |||||||||||||||||||||||

| Goodwill |

18,124 | — | 18,124 | — | 18,124 | |||||||||||||||||||||||

| Intangible assets, net |

13,759 | — | 13,759 | — | 13,759 | |||||||||||||||||||||||

| Prepaid expenses and other assets |

923 | — | 923 | 16,154 | (C | ) | 17,047 | |||||||||||||||||||||

| (30 | ) | (A | ) | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total assets |

$ | 45,037 | $ | 167 | $ | 45,204 | $ | 21,348 | $ | 66,552 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Liabilities, Redeemable Partners’ Capital and Partners’ Deficit: |

||||||||||||||||||||||||||||

| Accounts payable and accrued expenses |

$ | 4,752 | $ | 10,000 | (B | ) | $ | 14,752 | $ | (10,000 | ) | (A | ) | $ | 4,752 | |||||||||||||

| Accrued compensation |

1,438 | 2,880 | (C | ) | 3,809 | — | 3,809 | |||||||||||||||||||||

| (509 | ) | (C | ) | |||||||||||||||||||||||||

| Notes payable |

4,350 | — | 4,350 | — | 4,350 | |||||||||||||||||||||||

| Deferred rent |

2,139 | — | 2,139 | — | 2,139 | |||||||||||||||||||||||

| Deferred tax and other liabilities |

514 | — | 514 | 4,634 | (C | ) | 5,148 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total liabilities |

13,193 | 12,371 | 25,564 | (5,366 | ) | 20,198 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Redeemable partners’ capital |

113,764 | (113,764 | ) | (D | ) | — | — | — | ||||||||||||||||||||

| Notes receivable from partners |

(2,716 | ) | 2,549 | (A | ) | — | — | — | ||||||||||||||||||||

| 167 | (A | ) | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total redeemable partners’ capital |

111,048 | (111,048 | ) | — | — | — | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Partners’ Capital/Stockholder’s Equity: |

||||||||||||||||||||||||||||

| Preferred stock, par value $0.01, 10,000,000 shares authorized; and zero shares issued and outstanding, as adjusted |

— | — | — | — | ||||||||||||||||||||||||

| Class A Common stock, par value $0.01, 50,000,000 shares authorized; and 4,687,071 shares issued and outstanding, as adjusted |

— | — | — | 47 | (A | ) | 47 | |||||||||||||||||||||

| Class B Common stock, par value $0.01, 25,000,000 shares authorized; and 6,562,939 shares issued and outstanding, as adjusted |

— | — | — | 66 | (A | ) | 66 | |||||||||||||||||||||

| Additional paid-in capital |

— | — | — | 56,243 | (A | ) | 67,763 | |||||||||||||||||||||

| 11,520 | (C | ) | ||||||||||||||||||||||||||

73

| Silvercrest L.P. Historical |

Reorganization Adjustments (1) |

Reorganization Adjustment Pro Forma Note |

As Adjusted Before Offering |

Offering Adjustments (2) |

Offering Adjustments Pro Forma Note |

Silvercrest Asset Management Group Inc. Consolidated Pro Forma |

||||||||||||||||||||||

| Partners’ capital |

48,915 | (19,275 | ) | (D | ) | 19,640 | (19,640 | ) | (A | ) | — | |||||||||||||||||

| (10,000 | ) | (B | ) | |||||||||||||||||||||||||

| Excess of liabilities, redeemable partners’ capital and partners’ capital over assets |

(128,119 | ) | 128,119 | (D | ) | — | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total partners’ deficit/ stockholders’ equity |

(79,204 | ) | 98,844 | 19,640 | 48,236 | 67,876 | ||||||||||||||||||||||

| Non-controlling interests |

— | — | — | (21,522 | ) | (B | ) | (21,522 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total liabilities, redeemable partners’ capital and partners’ deficit/stockholders’ equity |

$ | 45,037 | $ | 167 | $ | 45,204 | $ | 21,348 | $ | 66,552 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

74

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE THREE MONTHS ENDED MARCH 31, 2013

| Silvercrest L.P. Historical |

Reorganization Adjustments (1) |

Reorganization Adjustment Pro Forma Note |

As Adjusted Before Offering |

Offering Adjustments (2) |

Offering Adjustments Pro Forma Note |

Silvercrest Asset Management Group Inc. Consolidated Pro Forma |

||||||||||||||||||||||

| Revenue: |