UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant |

Filed by a Party other than the Registrant |

Check the appropriate box:

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(5)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to §240.14a-12 |

SILVERCREST ASSET MANAGEMENT GROUP INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x |

No fee required. |

o |

Fee paid previously with preliminary materials. |

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SILVERCREST ASSET MANAGEMENT GROUP INC.

1330 AVENUE OF THE AMERICAS

38TH FLOOR

NEW YORK, NEW YORK 10019

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

June 8, 2022

It is my pleasure to invite you to attend the 2022 Annual Meeting of the Stockholders (the “Annual Meeting”) of Silvercrest Asset Management Group Inc. (the “Company”), a Delaware corporation, on Wednesday, June 8, 2022, at 10:00 a.m., Eastern Time in a virtual-only meeting format. Stockholders will not be able to attend the Annual Meeting in person, however stockholders of record as of the close of business on April 22, 2022 will be able to vote and view the list of stockholders during the Annual Meeting through the online platform. In addition, a complete list of stockholders entitled to vote at the Annual Meeting will be made available electronically upon request no later than ten days prior to the meeting date.

At the Annual Meeting, stockholders will vote on the following matters, which are further described in the attached proxy statement (the “Proxy Statement”):

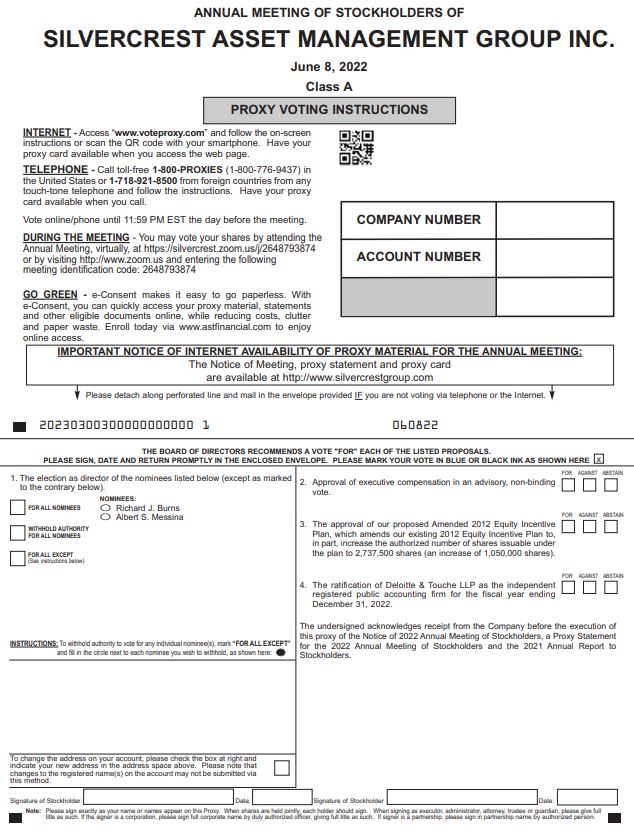

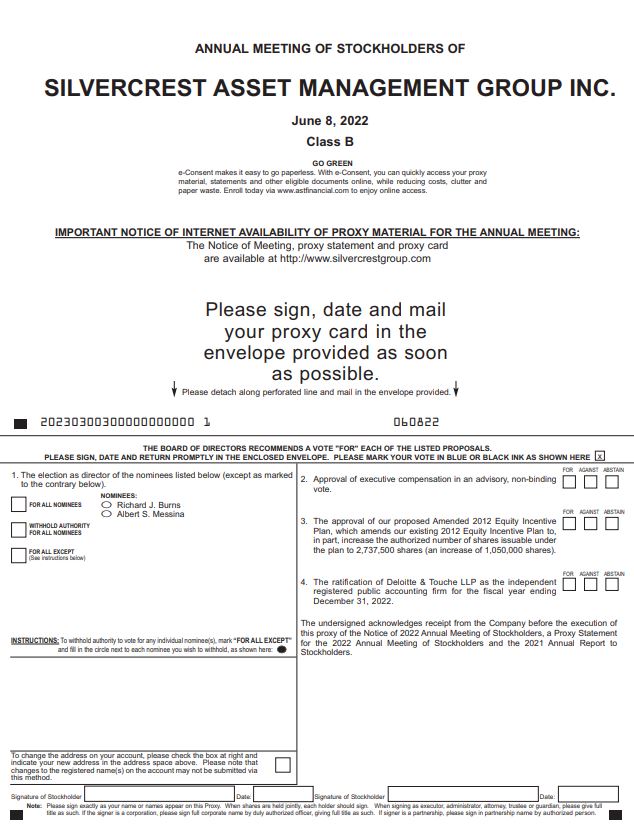

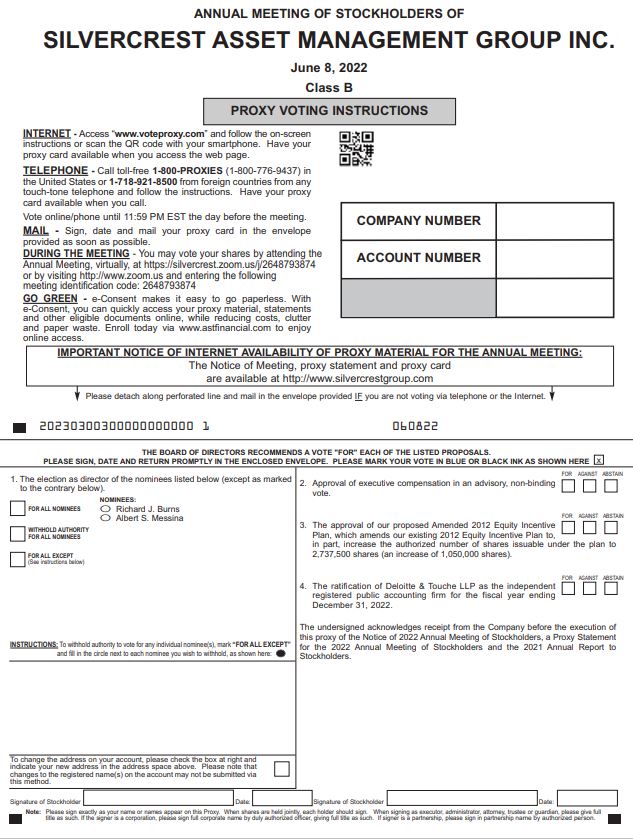

1. Election of the nominees named in the Proxy Statement to the Board of Directors (the “Board”) to serve until the 2025 annual meeting of stockholders;

2. Approval of executive compensation in an advisory, non-binding vote;

3. To approve our proposed Amended 2012 Equity Incentive Plan, which amends our existing 2012 Equity Incentive Plan to, in part, increase the authorized number of shares issuable under the plan to 2,737,500 shares (an increase of 1,050,000 shares);

4. Ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for 2022; and

5. Action upon such other matters, if any, as may properly come before the meeting.

The Board set April 22, 2022 as the Record Date. Only holders of record of our common stock at the close of business on that day are entitled to vote at our Annual Meeting or any adjournment of our Annual Meeting.

We invite you to attend our virtual Annual Meeting and vote. We urge you, after reading the Proxy Statement, to sign and return the enclosed proxy card as promptly as possible in the enclosed postage prepaid envelope or vote your proxy by Internet or telephone by following the instructions on the form of proxy. Whether or not stockholders plan to attend the virtual Annual Meeting, Silvercrest urges stockholders to select one of the methods described in the proxy materials to vote and submit their proxies in advance of the meeting.

By order of the Board of Directors,

David J. Campbell

General Counsel and Secretary

New York, New York

April 29, 2022

TABLE OF CONTENTS

|

1 |

|

|

7 |

|

|

7 |

|

|

9 |

|

|

14 |

|

|

16 |

|

|

17 |

|

|

21 |

|

|

23 |

|

|

24 |

|

|

29 |

|

|

30 |

|

|

31 |

|

|

32 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|

38 |

|

40 |

|

|

41 |

|

|

42 |

|

|

|

|

SILVERCREST ASSET MANAGEMENT GROUP INC.

PROXY STATEMENT

FOR 2022 ANNUAL MEETING OF STOCKHOLDERS

ABOUT THE ANNUAL MEETING AND VOTING

Important Notice Regarding Availability of Proxy Materials for Stockholder Meeting to be Held on June 8, 2022.

This Proxy Statement and the 2021 Annual Report to Stockholders are available on our Internet website at http://ir.silvercrestgroup.com.

What is the purpose of the Annual Meeting?

At our Annual Meeting, the stockholders will act upon the matters outlined in the Notice of Meeting on the first page of this Proxy Statement, including the election of the nominees named below as directors, the approval of executive compensation in an advisory, non-binding vote; the approval of our proposed Amended 2012 Equity Incentive Plan, which amends our existing 2012 Equity Incentive Plan to, in part, increase the authorized number of shares issuable under the plan to 2,737,500 shares (an increase of 1,050,000 shares); and ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for fiscal year 2022. This Proxy Statement summarizes the information you need to know to vote at the Annual Meeting. This Proxy Statement and form of proxy were first mailed to stockholders on or about April 29, 2022.

When and where will the Meeting be held?

The 2022 Annual Meeting will be held on Wednesday, June 8, 2022, at 10:00 a.m., Eastern Time in a virtual-only meeting format. Stockholders will not be able to attend the Annual Meeting in person, however stockholders of record as of the close of business on April 22, 2022 will be able to vote and view the list of stockholders during the Annual Meeting through the online platform.

Investors can access the virtual Annual Meeting and participate in the following ways:

Whether or not stockholders plan to attend the virtual Annual Meeting, Silvercrest urges stockholders to select one of the methods described in the proxy materials to vote and submit their proxies in advance of the meeting.

1

Who is soliciting my vote?

Our Board of Directors (the “Board”) is soliciting your proxy to vote at the Annual Meeting.

What am I voting on?

You are voting on four proposals:

(“Proposal No. 1”):

What are the voting recommendations of the Board?

The Board recommends the following votes:

Will any other matters be voted on?

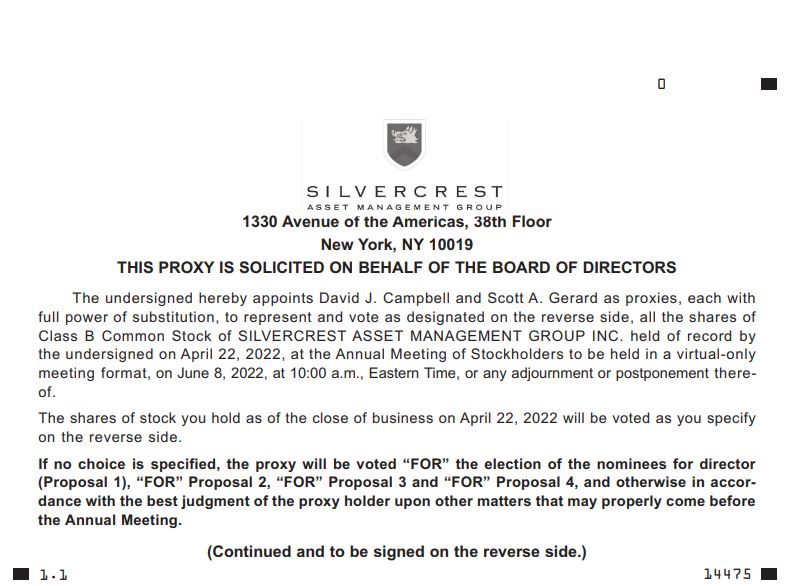

The Board does not intend to present any other matters at the Annual Meeting. We do not know of any other matters that will be brought before the stockholders for a vote at the Annual Meeting. If any other matter is properly brought before the Annual Meeting, your signed proxy card gives authority to David Campbell and Scott Gerard as proxies, with full power of substitution (“Proxies”), to vote on such matters in their discretion in accordance with their best judgment.

Who is entitled to vote?

Stockholders of record as of the close of business on April 22, 2022 (the “Record Date”) are entitled to vote at the Annual Meeting.

How many votes do I have?

You will have one vote for every share of Company common stock that you owned at the close of business on the Record Date. You are not entitled to cumulate your votes.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many stockholders hold their shares through a broker or bank rather than directly in their own names. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

2

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, American Stock Transfer, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by the Company.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your bank or broker, which is considered the stockholder of record of these shares. As the beneficial owner, you have the right to direct your bank or broker how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you bring with you a legal proxy from the stockholder of record. Your bank or broker has enclosed a voting instruction card for you to use for providing directions for how to vote your shares.

How do I vote?

If you are a stockholder of record, there are four ways to vote:

If you vote by Internet or telephone, your vote must be received by Tuesday, June 7, 2022, at 10:00 AM, Eastern Time, the day before the Annual Meeting. Your shares will be voted as you indicate. If you sign and return your proxy card but you do not indicate your voting preferences, the Proxies will vote your shares FOR Proposal Nos. 1, 2 3 and 4.

If your shares are held in street name, you should follow the voting directions provided by your bank or broker. You may complete and mail a voting instruction card to your bank or broker or, in most cases, submit voting instructions by the Internet or telephone to your bank or broker. If you provide specific voting instructions by mail, the Internet or telephone, your shares should be voted by your bank or broker as you have directed. AS A RESULT OF NASDAQ’S RULES, YOUR BANK OR BROKER CANNOT VOTE WITH RESPECT TO ANY PROPOSAL, EXCEPT FOR PROPOSAL NO. 4, UNLESS IT RECEIVES VOTING INSTRUCTIONS FROM YOU.

We will distribute electronic versions of written ballots at the Annual Meeting to any stockholder who wants to vote. If you hold your shares in street name, you must request a legal proxy from your bank or broker to vote in person at the Annual Meeting.

Can I change my vote or revoke my proxy?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

3

If your shares are held in street name, you must follow the specific directions provided to you by your bank or broker to change or revoke any instructions you have already provided to your bank or broker.

Is my vote confidential?

It is the policy of the Company that all proxies, ballots, voting instructions and tabulations that identify the vote of a stockholder will be kept confidential from the Company, its directors, officers and employees until after the final vote is tabulated and announced, except in limited circumstances, including: any contested solicitation of proxies; when required to meet a legal requirement, to defend a claim against the Company; or to assert a claim by the Company and when written comments by a stockholder appear on a proxy card or other voting material.

How are votes counted?

American Stock Transfer, our transfer agent, has been appointed by the Board as the inspector of elections for the Annual Meeting. It will tabulate the votes received for each nominee for director and all other items of business at the Annual Meeting. American Stock Transfer will separately count, for the proposal to elect a director, votes “For,” “Withhold” and broker non-votes, and, with respect to other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Broker non-votes are counted for purposes of determining whether a quorum is present and will have no effect and will not be counted towards the vote total for any proposal.

Who pays for soliciting proxies?

We will pay for the cost of preparing, assembling, printing, and mailing this Proxy Statement and the accompanying form of proxy to our stockholders, as well as the cost of soliciting proxies relating to the Annual Meeting. We may request banks and brokers to solicit their customers, on whose behalf such banks and brokers hold our common stock in street name. Our directors, officers, and employees may solicit proxies on our behalf in person, by phone, or by electronic communication. We will reimburse these banks and brokers for their reasonable out-of- pocket expenses for these solicitations. We will pay no additional compensation to our officers, directors, or employees for these activities.

What is the quorum requirement of the Annual Meeting?

A majority of the issued and outstanding shares of our common stock on the Record Date, represented in person or by proxy at the Annual Meeting, constitutes a quorum for voting on proposals at the Annual Meeting. If you vote, your shares will be part of the quorum. Shares of our Class A and Class B common stock vote together as a single class. Both abstentions, including those recorded by brokers holding their customers’ shares, and broker non-votes will be counted in determining the quorum. On the Record Date, there were 9,871,990 and 4,590,797 shares of Class A and Class B common stock, respectively, outstanding.

What are broker non-votes?

Broker non-votes occur when holders of record, such as banks and brokers holding shares on behalf of beneficial owners, do not receive voting instructions from the beneficial owners by the date specified in the statement requesting voting instructions that has been provided by the bank or broker.

If that happens, the bank or broker may vote those shares only on matters as permitted by NASDAQ. NASDAQ prohibits banks and brokers from voting uninstructed shares in, among other things, the election of directors and matters related to executive compensation; accordingly, banks and brokers cannot vote with respect to any Proposal presented for consideration in this Proxy Statement except for Proposal No. 4 unless they receive voting instructions from the beneficial owners. Broker non-votes are not treated as votes cast under Delaware law.

What vote is required to approve each proposal?

Proposal No. 1. For the election of directors, a nominee for director will be elected if he receives a plurality of the votes of the shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. This means that the candidate who receives the most votes for a particular slot will be elected for that slot, whether or not the votes for that candidate represent a majority. Withholds and broker non-votes have no effect on the outcome of the proposal.

4

Proposal No. 2. Approval of our executive compensation in an advisory, non-binding vote requires the approving vote of a majority of the votes of shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. Abstentions have the effect of a vote against the proposal. Broker non-votes have no effect on the outcome of the proposal.

Proposal No. 3. Approval of our proposed Amended and Restated 2012 Equity Incentive Plan, which amends our existing 2012 Equity Incentive Plan to, in part, increase the authorized number of shares issuable under the plan to 2,737,500 shares (an increase of 1,050,000 shares) requires the approving vote of a majority of the votes of shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. Abstentions have the effect of a vote against the proposal. Broker non-votes have no effect on the outcome of the proposal.

Proposal No. 4. Ratification of our independent registered public accounting firm requires the approving vote of a majority of the votes of shares present in person, or represented by proxy, and entitled to vote at the Annual Meeting. Abstentions have the effect of a vote against the proposal. Broker non-votes have no effect on the outcome of the proposal.

Who can attend the Annual Meeting?

Only Silvercrest Asset Management Group Inc. stockholders as of the close of business on the Record Date may attend the Annual Meeting.

What do I need to do to attend the Annual Meeting?

If you are a stockholder of record, your proxy card is your admission ticket to the Annual Meeting. If you own shares in street name, you will need to ask your broker or bank for an admission ticket in the form of a legal proxy. You will need to provide the legal proxy at the virtual Annual Meeting along with valid picture identification. If you do not receive the legal proxy in time, provide your most recent brokerage statement at the virtual Annual Meeting. We can use your statement to verify your ownership of our common stock and admit you to the Annual Meeting; however, you will not be able to vote your shares at the Annual Meeting without a legal proxy.

What does it mean if I get more than one proxy card?

It means you own shares in more than one account. You should vote the shares on each of your proxy cards.

How can I consolidate multiple accounts registered in variations of the same name?

If you have multiple accounts, we encourage you to consolidate your accounts by having all your shares registered in exactly the same name and address. You may do this by contacting our transfer agent, American Stock Transfer & Trust Company, LLC, by phone at (800) 937-5449 or by mail at 6201 15th Avenue, Brooklyn, New York 11219.

I own my shares indirectly through my broker, bank or other nominee. Will I receive multiple copies of the annual report, proxy statement and other mailings because more than one person in my household is a beneficial owner? How can I change the number of copies of these mailings that are sent to my household?

If you and other members of your household are beneficial owners, you may receive multiple copies of the annual report and proxy statement and other mailings at your household. You can eliminate this duplication of mailings by contacting your broker, bank or other nominee. Duplicate mailings in most cases are wasteful for us and inconvenient for you, and we encourage you to eliminate them whenever you can. If you have eliminated duplicate mailings, but for any reason would like to resume them, you must contact your broker, bank or other nominee.

I own my shares directly as a registered owner of Company stock and so do other members of my family living in my household. How can I set the number of copies of the annual report and proxy statement that will be delivered to my household?

Family members living in the same household that are registered owners of Company stock will receive only one copy per household of the annual report, proxy statement and most other mailings. The only item that will be separately mailed for each registered stockholder or account is a proxy card. If you wish to receive separate copies in your name, apart from others in your household, you must contact our transfer agent, American Stock Transfer &

5

Trust Company, LLC, by phone at (800) 937-5449 or by mail at 6201 15th Avenue, Brooklyn, New York 11219, and request that action. Within 30 days after your request is received, we will send you separate mailings. If, for any reason, you and members of your household receive multiple copies and you want to eliminate the duplications, please also contact American Stock Transfer and request that action. That request must be made by each person in the household entitled to receive the materials.

Multiple stockholders live in my household and I want to receive my own copy of this year’s Annual Report and Proxy Statement. How can I obtain my own separate copy of those documents for the Annual Meeting in June?

You may download them from our Internet website, http://ir.silvercrestgroup.com. If you want copies mailed to you and you are a beneficial owner, you must request them from your broker, bank, or other nominee. If you want copies mailed to you and you are a stockholder of record, we will mail them promptly if you request them from our corporate office by phone at (212) 649-0600 or by mail to 1330 Avenue of the Americas, 38th Floor, New York, New York 10019. We cannot guarantee you will receive mailed copies before the Annual Meeting.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and publish final results in a Report on Form 8-K within four business days following the Annual Meeting.

What is the deadline for consideration of stockholder proposals or director nominations for the 2023 annual meeting of stockholders?

If you are a stockholder and you want to present a proposal at the 2023 annual meeting and have it included in our proxy statement for that meeting, you must submit the proposal in writing to our offices at 1330 Avenue of the Americas, 38th Floor, New York, New York 10019, no later than December 30, 2022. Applicable Securities and Exchange Commission (“SEC”) rules and regulations govern the submission of stockholder proposals and our consideration of them for inclusion in next year’s proxy statement.

If you want to present a proposal at the 2023 annual meeting (but not have the proposal included in our proxy statement) or to nominate a person for election as a director, you must comply with the requirements set forth in our bylaws. Our bylaws require, among other things, that our corporate secretary receive written notice from the stockholder of intent to present such proposal or nomination no less than 90 days and no more than 120 days prior to the first anniversary of the date of the preceding year’s annual meeting if such meeting is to be held on a day that is not more than 30 days in advance of the anniversary of the previous year’s annual meeting or not later than 70 days after the anniversary of the previous year’s annual meeting. Therefore, assuming our next annual meeting is held on or about June 8, 2023, we must receive notice of such proposal no earlier than February 8, 2023 and no later than March 10, 2023. The notice must contain the information required by our bylaws. You may obtain a print copy of our bylaws by submitting a request to: 1330 Avenue of the Americas, 38th Floor, New York, New York 10019. Our bylaws are also available on our website at http://ir.silvercrestgroup.com. Management may vote proxies in its discretion on any matter at the 2022 annual meeting if we do not receive notice of the matter within the time frame described in this paragraph. In addition, any person presiding at the meeting may exclude any matter that is not properly presented in accordance with these requirements.

6

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting, you will vote to elect as director the nominees listed below to serve until our 2025 Annual Meeting of stockholders or until his successor is elected and qualified. The Board has nominated Richard J. Burns and Albert S. Messina for election as directors. The nominees are current members of the Board. The nominees have consented to being named in this Proxy Statement as nominees and have agreed to serve as directors if elected. Neither Mr. Burns nor Mr. Messina have any family relationship with any of our executive officers. In the normal course of its deliberations, the Board may decide at a later time to add one or more directors who possess skills and experience that may be beneficial to the Board and our Company.

The persons named as Proxies in the accompanying form of proxy have advised us that, consistent with the Board’s recommendation, at the Annual Meeting, unless otherwise directed, they intend to vote the shares covered by the Proxies FOR the election of the nominees named below. If one or more of the nominees are unable to serve, or for good cause will not serve, the persons named as Proxies may vote for the election of any substitute nominee that the Board may propose. The persons named as Proxies may not vote for a greater number of persons than the number of nominees named above.

Nominees for Election to the Board

The following table provides information about our nominees for director as of the Record Date, April 22, 2022:

Name |

|

Age |

|

Position |

|

Richard J. Burns |

|

62 |

|

Director |

|

Albert S. Messina |

|

74 |

|

Managing Director and Portfolio Manager and Director |

|

Richard J. Burns, 62, is a current member of the Board. Richard J. Burns founded Blackhall Ventures in 2021 and is currently its General Partner and Chairman of its operating companies. Prior to founding Blackhall Ventures, Mr. Burns co-founded Isis Ventures Partners in 2002 and is currently one of its general partners and Chairman of its operating companies. Prior to co-founding Isis, Mr. Burns was President and Chief Executive Officer of Thomson Financial Media, a company holding the banking, insurance and electronic commerce media assets of The Thomson Corporation. Mr. Burns also previously served as Chief Executive Officer and publisher of Institutional Investor, a leading media business for fund management and finance professionals. Mr. Burns is currently a director on the board of Interaudi Bank, an FDIC-regulated bank based in New York. He serves as Chairman of the bank’s audit committee and is a member of its compliance committee. He also serves as Chairman of the board of Intelligent Security Systems, a leading provider of algorithmic software solutions for the global video intelligence industry. Mr. Burns currently serves on the board of Carnegie Hall, representing New York City Comptroller Scott Stringer. Mr. Burns has previously served as a member of the Board of Trustees of the American Museum of Natural History and as a member of the Board of Trustees of the David Rockefeller-founded Americas Society. Mr. Burns was educated at St. John’s College, Oxford University, where he received B.A. and M.A. degrees. He subsequently received his Masters of Science from Columbia University’s Graduate School of Journalism.

Based on his experience and qualifications, Mr. Burns was elected as a member of the Board, and we believe he should continue as a Board Member.

Albert S. Messina, 74, is a current member of the Board. He was elected to the Board on March 19, 2014. Mr. Messina joined our Company in April 2002 as a Managing Director and Portfolio Manager of equity and fixed income portfolios. Prior to 2002, Mr. Messina was a Managing Director at Credit Suisse Asset Management (CSAM), where he served in a similar capacity. He arrived at CSAM as a result of that firm’s merger with DLJ, where he had worked since 1983. Previously, he spent 14 years with Bankers Trust Company, where he advised private clients and oversaw the fiduciary department’s Tax Services Division. Mr. Messina holds a B.A. in Economics from Brooklyn College.

7

Mr. Messina has decades of experience in the asset management industry, including over a decade of leadership experience at Silvercrest. Based on his experience and qualifications, Mr. Messina was elected as a member of the Board, and we believe he should continue as a Board Member.

Other Current Members of the Board

Brian D. Dunn., 67, is a current member of the Board. Mr. Dunn joined McLagan Partners (an Aon Hewitt Company), a provider of compensation consulting services, in 1998 and retired as Chairman of McLagan and CEO of Performance, Reward & Talent for Aon Hewitt Consulting Worldwide in December 2015. He is a board member of Spire Technologies and Solutions Private Limited, the Phi Delta Theta Educational Foundation, and SullivanCotter which is a private consulting firm focused on the Healthcare sector. Mr. Dunn received a B.S. degree summa cum laude from the New York State School of Industrial and Labor Relations at Cornell University and an M.B.A. with highest honors from the Cornell University Graduate School of Management.

Mr. Dunn has over 40 years of experience specializing in incentive and executive compensation and has had several compensation committee relationships with publicly traded companies. His client base was exclusively financial services firms including many asset managers. Based on his experience and qualifications, Mr. Dunn was elected as a member of the Board.

Darla M. Romfo, 61, is a current member of the Board. Ms. Romfo is a lawyer and a CPA who has had experience working in all three sectors of our economy—private, government and not-for-profit. After working in private practice as an attorney in tax law, Ms. Romfo worked closely as Counsel to two former United States Senators (Senator Kent Conrad and Senator John Breaux) in their roles as members of the Senate Finance Committee, as Legislative Director to each Senator, and with Senator Breaux in his positions within the Senate Democratic Leadership.

Since 1999, Ms. Romfo has served as President and Chief Operating Officer of the Children’s Scholarship Fund, a national not-for-profit dedicated to providing partial scholarships to low-income children to attend private school. Ms. Romfo is a frequent speaker on education and parental choice, and is currently on the boards of Drexel Fund and Brilla College Prep Charter Schools. She also serves as a member of the Commission on Presidential Scholars. Ms. Romfo received a B.A. degree in Political Science and a B.S.B.A. degree in Accounting from the University of North Dakota. She subsequently received her J.D. from The George Washington University Law School.

Based on her management, legal and financial experience and qualifications, Ms. Romfo was elected as a member of the Board.

Richard R. Hough III, 52, is our Chairman, Chief Executive Officer and President and a current member of the Board. Mr. Hough has served as Chairman of the Board since November 2015, President of Silvercrest Asset Management Group LLC, our operating subsidiary (“SAMG LLC”), since January 2012, as its Chief Operating Officer from July 2010 to November 2013 and as its Chief Executive Officer since November 2013. He has been a member of the Company’s Executive Committee since 2007. Mr. Hough, who joined us in 2003, has responsibility for all aspects of our operations, including corporate strategy and development. Mr. Hough recently served as a member of the executive committee of and member of the Board of Governors of the Investment Advisor Association, a not-for-profit organization that represents the interests of SEC-registered investment advisor firms. He serves on the advisory board of the New Criterion, a monthly review of the arts and intellectual life. He also serves as chairman of the board of the Institute for Family Studies. He serves on the boards of The Tunison Foundation, National Civic Arts Society, and Christendom College. Mr. Hough graduated with a degree in politics from Princeton University.

Mr. Hough has been involved in the strategy of our Company for nineteen years. His various leadership roles enable him to provide valuable insight on the strategic direction of the Company. Based on his experience and qualifications, Mr. Hough was elected as a member of the Board.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE FOR THE BOARD’S NOMINEES.

8

CORPORATE GOVERNANCE

Overview

Our Company believes that good corporate governance practices reflect our values and support our strong strategic and financial performance. The compass of our corporate governance practices can be found in our bylaws and our Code of Business Conduct and Ethics, which were adopted by the Board to guide our Company, our Board and our employees. The charter of each standing Committee of the Board, spelling out the roles and responsibilities delegated to each Committee, can be found at http://ir.silvercrestgroup.com. In addition, the Board has established policies and procedures that address matters such as transactions with related persons and the independence and qualifications of our directors. This “Corporate Governance” section provides insight into how the Board has implemented these policies and procedures to benefit our Company and our stockholders.

Board Composition

The Board currently consists of five directors. Messrs. Burns and Dunn and Ms. Romfo qualify as independent directors under the corporate governance standards of NASDAQ. The Board consists of a majority of independent directors within the meaning of the applicable rules of the SEC and NASDAQ. At least one member, Mr. Burns, has been determined by the Board to be an Audit Committee financial expert within the meaning of applicable SEC and NASDAQ rules. The Nominating and Corporate Governance Committee will consider a person’s continued service as a director once their term is expiring without regard to the age of such person.

Meetings of Directors

During 2021, the Board met a total of six times. During 2021, the Audit Committee met four times, the Compensation Committee met three times, and the Nominating and Corporate Governance Committee met once, and the meetings were presided over by Mr. Burns, Mr. Dunn and Mr. Conrad and Ms. Romfo, respectively. All six of the full Board meetings were presided over by Richard R. Hough III. For 2022, there are four scheduled non-telephonic meetings of the Board. Mr. Hough is expected to preside over these meetings during 2022.

Staggered Board

The Board is divided into three staggered classes of directors of the same or nearly the same number and each director is assigned to one of the three classes. At each annual meeting of the stockholders, a class of directors will be elected for a three-year term to succeed the directors of the same class whose terms are then expiring. The term of the current Class II directors expires upon the election and qualification of successor directors at this year’s Annual Meeting. The term of the Class III directors elected at this year’s Annual Meeting will expire upon the election and qualification of successor directors at the annual meeting of stockholders to be held during the year 2025. The terms of the other directors expire upon the election and qualification of successor directors at the annual meeting of stockholders to be held during the years 2023 for the Class I director and 2024 for the Class II directors.

While the Board is currently composed of five directors, our second amended and restated certificate of incorporation provides that the number of directors serving on the Board shall be fixed from time to time by a resolution of a majority of the Board, provided that the Board shall consist of no fewer than three directors nor more than eleven directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class shall consist of one-third of the Board.

Board Leadership Structure

The Board consists of two non-independent directors and three independent directors. Richard R. Hough III serves as both Chairman of the Board and Chief Executive Officer. The Board understands that there is no single,

9

generally accepted approach to providing Board leadership and that given the dynamic and competitive environment in which we operate, the right Board leadership structure may vary as circumstances warrant. To this end, the Board does not have a policy mandating the combination or separation of the roles of Chairman of the Board and Chief Executive Officer. The Board has not designated a lead independent director but believes that its leadership structure is appropriate given the active role that the independent directors play on the Board’s standing committees. The Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Stockholder and Interested Party Communications with the Board

Communications with the Board Generally. Stockholders who desire to communicate with the Board, or with a specific director, including on an anonymous or confidential basis, may do so by delivering a written communication to the Board, 1330 Avenue of the Americas, 38th Floor, New York, New York 10019. The General Counsel will not edit or modify any such communication received and will forward each such communication to the appropriate director or directors, as specified in the communication. If the envelope containing a communication that a stockholder wishes to be confidential is conspicuously marked “Confidential,” the General Counsel will not open the communication. Communications will be forwarded by the General Counsel to the Board or any specified directors on a bi-monthly basis. The General Counsel will ensure the timely delivery of time sensitive communications to the extent such communication indicates time sensitivity. In addition, we have a policy that each of our directors should make every reasonable effort to attend each annual meeting of stockholders so that stockholders can communicate with the Board during these meetings. All of the members of our Board, except Mr. Messina, attended the 2021 Annual Meeting of Stockholders.

Interested Party Communications with our Independent Directors, our Non-Management Directors. Any interested party, including stockholders, who desires to communicate directly with one or more of the independent directors or our non-management directors as a group, including on an anonymous or confidential basis, may do so by delivering a written communication to the independent directors or the non-management directors as a group, 1330 Avenue of the Americas, 38th Floor, New York, New York 10019. The General Counsel will not open a communication that is addressed to one or more of our independent directors or our non-management directors as a group and will forward each such communication to the appropriate individual director or group of directors, as specified in the communication. Such communications will not be disclosed to the non-independent or management members of the Board or to management unless so instructed by the independent or non-management directors. Communications will be forwarded by the General Counsel on a bi- monthly basis. The General Counsel will ensure the timely delivery of time sensitive communications to the extent such communication indicates time sensitivity.

Board Selection and Diversity

On August 6, 2021, the SEC approved amendments to the Listing Rules of NASDAQ related to board diversity. New Listing Rule 5605(f) (the “Diverse Board Representation Rule”) will require each NASDAQ-listed company, subject to certain exceptions, (1) to have at least one director who self-identifies as female, and (2) to have at least one director who self-identifies as Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, two or more races or ethnicities, or as LGBTQ+, or (3) to explain why the company does not have at least two directors on its board who self-identify in the categories listed above. In addition, new Listing Rule 5606 (the “Board Diversity Disclosure Rule”) requires each NASDAQ-listed company, subject to certain exceptions, to provide statistical information about the company’s current board of directors, in a uniform format, related to each director’s self-identified gender, race, and self-identification as LGBTQ+. Although we are not required to fully comply with the Diverse Board Representation Rule until 2025, we currently comply with the new diversity standards and intend to continue to do so.

10

The table below provides certain highlights of the composition of our Board members. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Rule 5605(f).

Board Diversity Matrix (As of April 29, 2022) |

||||

Board Size: |

||||

Total Number of Directors |

5 |

|||

|

Female |

Male |

Non-Binary |

Did not Disclose Gender |

Part I: Gender Identity |

||||

Directors |

1 |

4 |

0 |

0 |

Part II: Demographic Background |

||||

African American or Black |

- |

- |

- |

- |

Alaskan Native or Native American |

- |

- |

- |

- |

Asian |

- |

- |

- |

- |

Hispanic or Latinx |

- |

- |

- |

- |

Native Hawaiian or Pacific Islander |

- |

- |

- |

- |

White |

1 |

- |

- |

- |

Two or More Races or Ethnicities |

- |

- |

- |

- |

LGBTQ+ |

1 |

|||

Did not Disclose Demographic Background |

0 |

|||

Nominations for Directors

Identifying Director Candidates. When seeking candidates for election and appointment to the Board, our Nominating and Corporate Governance Committee will consider candidates that possess the integrity, leadership skills and competency required to direct and oversee our management in the best interests of our stockholders, clients, employees, communities we serve and other affected parties, and consider the competency of the Board as a whole. While we do not have a specific policy on diversity of the Board, our Nominating and Corporate Governance Committee considers composition of the Board, including issues of diversity, age and skills such as understanding asset management, investment management and finance. We believe the composition of our Board reflects a diversity of skills, professional and personal backgrounds and experience. With respect to the director nominees, the Nominating and Corporate Governance Committee also focused on the information described in the Board members’ biographical information set forth above.

Stockholder Recommendations for Director Candidates. The Nominating and Corporate Governance Committee will consider stockholder suggestions for nominees for directors. Shareholder recommendations for a candidate for director should be submitted to: Silvercrest Asset Management Group Inc., Office of the General Counsel, 1330 Avenue of the Americas, 38th Floor, New York, New York 10019.

Code of Business Conduct and Ethics

We expect and require all of our employees, directors, and any parties with whom we do business to conduct themselves in accordance with the highest ethical standards. Accordingly, we have adopted a Code of Business Conduct and Ethics, which outlines our commitment to, and expectations for, honest and ethical conduct by all of these persons and parties in their business dealings. A complete copy of our Code of Business Conduct and Ethics is available on our website at http://ir.silvercrestgroup.com. The Company intends to disclose any changes in, or waivers from, this code by posting such information on the same website or by filing a Form 8-K, in each case if such disclosure is required by rules of the SEC or NASDAQ.

Policy on Related Person Transactions

As a general matter, it is our preference to avoid related person transactions as we recognize that they can present potential or actual conflicts of interest. We recognize, however, that there are situations where related person transactions may be in the best interests of the Company and our stockholders, including situations where the

11

Company may obtain products or services of a nature, quantity or quality, or on other terms, that are not readily available from alternative sources or when the Company provides or obtains products or services to or from related persons on an arm’s length basis on terms comparable to those provided to unrelated third parties or on terms comparable to those provided to employees generally. Therefore, we have adopted a written Company policy for the review, approval or ratification of related person transactions, which is generally described below.

For the purposes of this policy, a “related person transaction” is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which the Company (including any of its subsidiaries) was, is or will be a participant and the amount involved exceeds the lesser of $120,000 or 1% of our average total assets at year end, and in which any related person had, has or will have a direct or indirect material interest. “Related person” means (i) any person who is, or at any time since the beginning of the Company’s last fiscal year was, a director or executive officer of the Company or a nominee to become a director of the Company; (ii) any person who is known to be the beneficial owner of more than 5% of any class of the Company’s voting securities; and (iii) any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of the director, executive officer, nominee or more than 5% beneficial owner, and any person (other than a tenant or employee) sharing the household of such director, executive officer, nominee or more than 5% beneficial owner.

When we become aware of a person’s status as a beneficial owner of more than 5% of any class of the our voting securities, our General Counsel is required to create a list, to the extent the information is readily available, of (i) if the person is an individual, the same information as is requested of directors and executive officers, and (ii) if the person is a firm, corporation or other entity, a list of principals or executive officers of the firm, corporation or entity, and update the list on a quarterly basis.

Current Related Person Transactions

We have entered into a registration rights agreement and a tax receivables agreement with our principals, who are the limited partners of Silvercrest, L.P., the managing member of SAMG LLC, our operating subsidiary. Our principals include Messrs. Richard R. Hough III, Scott A. Gerard, David J. Campbell, Albert S. Messina and J. Allen Gray.

Registration Rights Agreement. Pursuant to a resale and registration rights agreement that we entered into with our principals, we filed a registration statement on Form S-3, in 2014, for the sale of the shares of our Class A common stock that are issuable upon exchange of Class B units. The registration statement was also declared effective by the SEC in 2014. Pursuant to this agreement, when Silvercrest L.P. issues any Class B units to its employees, partners or other consultants pursuant to the 2012 Equity Incentive Plan, the recipient will be entitled to the same resale and registration rights, and will be subject to the same restrictions, as the principals holding Class B units outstanding after our initial public offering.

Tax Receivable Agreement. We have entered into a tax receivable agreement with our principals, and will enter into a tax receivable agreement with any future holders of Class B units, that requires us to pay them 85% of the amount of cash savings, if any, in U.S. federal, state and local income tax that we actually realize (or are deemed to realize in the case of an early termination payment by us, or a change in control) as a result of the increases in tax basis and certain other tax benefits related to entering into the tax receivable agreement, including tax benefits attributable to payments under the tax receivable agreement. We expect to benefit from the remaining 15% of cash savings, if any, realized. The tax receivable agreement will continue until all such tax benefits have been utilized or expired, unless we exercise our right to terminate the tax receivable agreement for an amount based on an agreed upon value of payments remaining to be made under the agreement. The tax receivable agreement will automatically terminate with respect to our obligations to a principal if a principal (i) is terminated for cause, (ii) breaches his or her non-solicitation covenants with our Company or (iii) voluntarily resigns or retires and competes with our Company in the 12-month period following resignation of employment or retirement, and no further payments will be made to such principal under the tax receivable agreement.

Management of Employees’ Personal Funds. The Company manages the personal funds of many of its employees and members of the families of those employees, including Messrs. Hough, Gerard, Campbell, Messina

12

and Gray, pursuant to investment management agreements in which it has agreed to reduce the advisory fees it charges to such employees and members of their families. The value of the discounts for fiscal year 2021 to the investment advisory services provided by the Company to Messrs. Scott A. Gerard and Albert S. Messina were approximately $16,000 and $43,000, respectively. The value of services provided by the Company to other executives was not significant.

13

MEETINGS AND COMMITTEES OF THE BOARD

The Board

Each director is expected to make every reasonable effort to attend each meeting of the Board and any Committee of which the director is a member and to be reasonably available to management and the other directors between meetings. Our entire Board met six times during 2021. Most of our Board and Committee meetings in 2021 took place on a virtual basis as a result of the COVID-19 pandemic. Mr. Conrad attended all the Board and Committee meetings prior to his retirement from the Board in June 2021. Messrs. Burns, Dunn, Hough and Messina attended all six Board meetings, all four Audit Committee meetings, all three Compensation Committee meetings, and the Nominating and Corporate Governance Committee meeting. Ms. Romfo, elected to the Board in June 2021, attended two Board meetings and two Audit Committee meetings. The Compensation Committee and Nominating and Corporate Governance Committee meetings took place prior to Ms. Romfo’s election to the Board.

Committees of the Board

We currently have an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which is comprised of independent directors in accordance with the listing standards of NASDAQ. In 2021, the Audit Committee met four times, the Compensation Committee met three times and the Nominating and Corporate Governance Committee met once. Mr. Conrad attended all the Board and Committee meetings prior to his retirement from the Board in June 2021. Messrs. Burns, Dunn, Hough and Messina attended all six Board meetings, all four Audit Committee meetings, all three Compensation Committee meetings and the Nominating and Corporate Governance Committee meeting. Ms. Romfo, elected to the Board in June 2021, attended two Board meetings and two Audit Committee meetings. The Compensation Committee and Nominating and Corporate Governance Committee meetings took place prior to Ms. Romfo’s election to the Board.

The following table sets forth the names of each current Committee member and the primary responsibilities of each Committee.

Name of Committee and Members for 2021 |

|

Primary Responsibilities |

Audit Richard J. Burns (Chairman and Audit Committee Financial Expert) Brian D. Dunn Darla M. Romfo |

• |

Reviews the audit plans and findings of our independent registered public accounting firm and our internal audit and risk review staff, as well as the results of regulatory examinations, and tracks management’s corrective action plans where necessary; |

• |

Reviews our financial statements, including any significant financial items and/or changes in accounting policies, with our senior management and independent registered public accounting firm; |

|

• |

Reviews our financial risk and control procedures, compliance programs regarding risk assessment and management and significant tax, legal and regulatory matters; and |

|

• |

Appoints our independent registered public accounting firm annually, evaluates its independence and performance, determines its compensation and sets clear hiring policies for employees or former employees of the independent registered public accounting firm. |

|

Compensation Richard Burns Brian D. Dunn (Chairman) Darla M. Romfo |

• |

Determines the compensation of the Chief Executive Officer and reviews, approves, and makes recommendations to the Board with respect to the compensation of our other executive officers; |

• |

Oversees, administers, and makes recommendations to the Board with respect to our cash and equity incentive plans; and |

|

• |

Reviews and makes recommendations to the Board with respect to director compensation. |

14

Nominating and Corporate Governance Richard Burns Brian D. Dunn Darla M. Romfo (Chairwoman)

|

• |

Makes recommendations to the Board regarding the selection of candidates, qualification and competency requirements for service on the Board and the suitability of proposed nominees as directors; |

• |

Advises the Board with respect to the corporate governance principles applicable to us; |

|

• |

Oversees the evaluation of the Board and management; |

|

• |

Reviews and approves in advance any related person transactions, other than those that are pre-approved pursuant to pre-approval guidelines or rules established by the Committee; |

|

• |

Reviews the form and amounts of director compensation and makes recommendations to the Board with respect thereto; and |

|

• |

Establishes guidelines or rules to cover specific categories of transactions. |

The Board has adopted written charters for each Committee setting forth the roles and responsibilities of each Committee. Each of the charters is available on our website at http://ir.silvercrestgroup.com.

Board’s Role in Risk Oversight

The Board is responsible for overseeing management in the execution of its responsibilities and for assessing our general approach to risk management. In addition, an overall review of risk is inherent in the Board’s consideration of our long-term strategies and other matters presented to the Board. The board exercises its responsibilities periodically as part of its meetings and also through the Board’s three Committees, each of which examines various components of enterprise risk as part of their responsibilities. For example, the Audit Committee has primary responsibility for addressing risks relating to financial matters, particularly financial reporting, accounting practices and policies, disclosure controls and procedures and internal control over financial reporting. The Audit Committee also has primary responsibility for reviewing and discussing our practices regarding risk assessment and management, including any guidelines or policies that govern the process by which we identify, monitor and handle major risks. The Nominating and Corporate Governance Committee oversees risks associated with the independence of the Board and potential conflicts of interest. The Compensation Committee has primary responsibility for risks and exposures associated with our compensation policies, plans and practices, regarding both executive compensation and the compensation structure generally, including whether it provides appropriate incentives that do not encourage excessive risk-taking. Senior management is responsible for assessing and managing our various exposures to risk on a day-to-day basis, including the creation of appropriate risk management programs and policies.

The Board’s role in risk oversight of our Company is consistent with our leadership structure, with the Chief Executive Officer and other members of senior management having responsibility for assessing and managing our risk exposure, with the Board and its Committees providing oversight in connection with those efforts. We believe this division of risk management responsibilities presents a consistent, systematic and effective approach for identifying, managing and mitigating risks throughout our Company.

15

DIRECTOR COMPENSATION

Under our director compensation program, each non-employee director receives annual compensation that is comprised of an annual cash retainer of $50,000, an annual equity retainer of $50,000, an additional $5,000 cash annually per Committee on which the director serves, and Committee chair cash retainers of $10,000, $5,000 and $5,000 for the chairperson of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, respectively. Employee directors do not receive any additional compensation for services as a director. In addition, all directors are reimbursed for reasonable out-of-pocket expenses incurred by them in connection with attending Board, Committee and stockholder meetings, including those for travel, meals and lodging. We reserve the right to change the manner and amount of compensation to our directors at any time.

2021 Director Summary Compensation Table

Information provided in the following table reflects the compensation delivered to our non-employee directors for our last completed fiscal year:

|

|

Fees Earned or |

|

|

Fees Earned or |

|

|

|

|

|||

|

|

Paid in Cash |

|

|

Paid in Stock |

|

|

Total |

|

|||

Name |

|

($) |

|

|

($)(1) |

|

|

($) |

|

|||

Richard J. Burns |

|

|

75,000 |

|

|

|

50,000 |

|

|

|

125,000 |

|

Winthrop B. Conrad, Jr. (2) |

|

|

17,500 |

|

|

|

12,500 |

|

|

|

30,000 |

|

Brian D. Dunn |

|

|

— |

|

|

|

120,000 |

|

|

|

120,000 |

|

Darla M. Romfo (3) |

|

|

23,333 |

|

|

|

29,167 |

|

|

|

52,500 |

|

16

COMPENSATION DISCUSSION AND ANALYSIS

This section summarizes the material elements and principles underlying our compensation policies, including those relating to our named executive officers. It generally describes the manner and context in which compensation is earned by, and awarded and paid to, our management and senior executives, who we refer to as our principals, and provides perspective on the tables and narratives that follow. For fiscal year 2021, the named executive officers of the Company were Richard R. Hough III, Chairman, Chief Executive Officer and President; Scott A. Gerard, Chief Financial Officer; David J. Campbell, General Counsel and Secretary; Albert S. Messina, Managing Director and Portfolio Manager; and J. Allen Gray, Managing Director – Institutional Business.

Except where the context requires otherwise and as otherwise set forth herein, references to “we”, “our” or “Company” in this Compensation Discussion and Analysis section refer to Silvercrest Asset Management Group Inc. and its consolidated subsidiaries, including Silvercrest L.P. (“Silvercrest L.P.” or “SLP”), the managing member of SAMG LLC, our operating subsidiary.

Philosophy and Objectives of Compensation Program

Our compensation program is designed to reward past performance at an individual, team, and company level, and encourages future contributions to achieving our strategic goals and enhancing stockholder value. Our method of compensating our principals is intended to meet the following objectives: (i) support our overall business strategy; (ii) attract, retain and motivate top-tier professionals within the investment management industry; and (iii) align the interests of our principals with those of our stockholders.

We believe that, in order to create long-term value for our stockholders, we need a skilled and experienced management team focused on achieving profitable and sustainable financial results, expanding our investment capabilities through disciplined growth, continuing to diversify sources of revenue and delivering superior client service. We depend on our management team to execute the strategic direction of our Company and maintain our standards for ethical, responsible and professional conduct. We also rely on our management team to manage our professionals and distribution channels and provide the operational infrastructure that allows our investment professionals to focus on achieving attractive investment returns and superior client service. In addition, we depend on our management team to encourage an entrepreneurial and collegial business culture.

The elements of our compensation and equity participation programs have contributed to our ability to attract and retain a highly qualified team of professionals. For our principals, we use, and expect to continue to use, cash and equity compensation programs and equity participation in a combination that has been successful for us in the past and that we believe will continue to be successful for us in the future. In addition to cash compensation for our principals, we have recognized performance and value, which we believe enhance our overall compensation objectives, by offering interests in Silvercrest L.P. By doing so, we have enabled our principals to share in the future profits, growth and success of our business.

Our compensation programs are focused on rewarding performance that increases long-term stockholder value, including growing revenues, retaining and expanding existing client relationships, developing new client relationships, developing new products, improving operational efficiency and managing risks. We periodically evaluate the success of our compensation and equity participation programs in achieving these objectives and adapt these programs as our Company grows in order to enable us to better achieve these, and future, objectives.

Determination of Compensation and Role of Directors and Principals in Compensation Decisions

Compensation decisions are subject to the discretion of the Executive Committee (which is composed of Mr. Hough, Mr. Gerard, Mr. Campbell, Mr. Messina and Mr. Gray) and, ultimately, our Chief Executive Officer, Mr. Hough. Historically, base salaries, annual bonuses and incentive compensation of our named executive officers are reviewed by the Executive Committee and adjusted as deemed necessary after taking into account both individual and company performance.

17

We have a Compensation Committee comprised solely of independent directors to assist the Board in the discharge of its responsibilities relating to the compensation of our named executive officers. In making its decisions, the Compensation Committee is guided by the recommendations of the Chief Executive Officer and the Executive Committee. The Compensation Committee, in its sole discretion, determines the compensation of the Chief Executive Officer and approves the compensation of the other named executive officers.

We have determined that it is important to encourage or provide a meaningful opportunity to acquire an amount of equity ownership by our principals to help align their interests with those of our Company and its shareholders. The allocation between cash and non-cash compensation has historically been based on a number of factors, including individual performance, company performance and company liquidity. These determinations vary from year to year. We may decide in future years to pay some or all of short-term and long- term incentives in equity depending upon the facts and circumstances existing at that time.

We have also not adopted specific policies with respect to short-term versus long-term compensation but believe that both elements are necessary for achieving our compensation objectives for all employees. Our base salaries and performance bonuses are targeted to be competitive for all employees. Equity awards for principals reward achievement of strategic long-term objectives, which we believe will contribute toward overall stockholder value.

We have not identified a specific peer group of companies for comparative purposes and have not engaged in formal competitive benchmarking of compensation against specific peer companies. We periodically use compensation consultants , and, historically, we have received regular and ongoing input from industry representatives and other market sources through our (1) participation on the Pershing Advisor Solutions, a service which provides a customized approach to understanding the RIA business and a range of solutions to help meet demand, with MFO/RIA peers; (2) participation in other custodian advisor forums and industry events; (3) review of compensation surveys by companies such as McLagan Partners and The Bower Group, which provide international consulting services to a range of clients; (4) review of industry publications featuring stories on compensation practices and metrics; and (5) review of the Moss Adams Adviser Compensation and Staffing Study, which is prepared by Pershing Advisor Solutions, Moss Adams LLP and IN Advisor Solutions and includes data on hundreds of advisory firms. In the past year, The Compensation engaged the services of McLagan to provide input on the competitiveness of named executive officer total compensation.

Our Chief Executive Officer has discretion to determine the compensation of the named executive officers (other than himself), subject to the approval of the Compensation Committee. Our Compensation Committee has overall oversight responsibility for our compensation policies, plans and programs. The Committee reviews our Company’s achievements and the achievements of our named executive officers and reviews the recommendation of the Chief Executive Officer in the final determination of the specific type and level of compensation of our other named executive officers. The Committee is also expected to set amount and mix of the compensation of our Chief Executive Officer.

Principal Components of Compensation

We have established compensation practices that directly link compensation with individual and company performance, as described below. These practices apply to all of our principals, including our named executive officers. Ultimately, ownership in our Company has been the primary tool we have used to attract and retain senior professionals. As of April 5, 2021, our principals indirectly held approximately 33% of the interests in Silvercrest L.P. The interests in Silvercrest L.P. currently held by our principals entitle them to receive distributions from Silvercrest L.P. The Company typically does not enter into employment agreements with members of its senior management and did not previously have an employment with Messrs. Gray and Hough. Because the Company recognizes that there is significant competition for talent within the industry, in 2018 and 2020 the Company decided to enter into employment agreements with Mr. Hough and Mr. Gray, respectively, to enhance the Company’s ability to retain them. The Compensation Committee of the Board determined that such agreements were in the best interests of the Company and its stockholders. For more details about Mr. Hough’s and Mr. Gray’s employment agreements please see page 22.

In 2021, we provided the following elements of compensation to our principals, the relative value of each of these components for individual principals varying based on job role and performance: (i) base salary; (ii) annual cash bonus; and (iii) other benefits and perquisites, each of which is described below. In addition, our Chief

18

Executive Officer, Chief Financial Officer, General Counsel and Secretary and Managing Director – Institutional Business received restricted stock units (“RSUs”) in 2021.

Stock Ownership Guidelines

While the compensation of our principals has primarily included a set base salary and a discretionary bonus, virtually all of our principals own equity interests in Silvercrest L.P. As stated above, we believe that equity ownership in our Company encourages principals to have a long-term view of our success, and a healthy concern for the entire company, rather than merely improving their own compensation. Principals are incentivized to grow and increase the value of their equity interests by adding to our overall revenue and guarding our expenses in a way that a non- equity owner would not. All of our principals have been offered multiple opportunities to acquire ownership interests in our Company, and in some cases, have received incentive compensation awards which include such interests.

Our principals have not historically been subject to mandated equity ownership or retention guidelines. It is our belief that the equity ownership by our principals ensure that their interests are directly aligned with those of our Company and our clients. Since our initial public offering, we have continued to promote broad and substantial equity ownership by our principals. In addition, while our principals remain employees of Silvercrest L.P., they are required to retain at least 25% of the Class B units in Silvercrest L.P. that they owned on the date of consummation of our initial public offering.

Each holder’s profits percentage is fixed at the date of acquisition of the equity interests in Silvercrest L.P., subject to dilution when additional equity interests in these entities are issued or accretion if existing equity interests in their entities are redeemed and not resold. Under the terms of its second amended and restated limited partnership agreement, Silvercrest L.P. may retain profits for future needs of the partnership.

19

An equity interest in Silvercrest L.P. also allows the holder to participate in the appreciation or depreciation in the value of Silvercrest L.P., from and after the date of the grant of the equity interest, by participating in defined capital or liquidity events (as defined in the second amended and restated limited partnership agreement) or by redemption following termination of employment. The redemption of these equity interests is described in detail below under “Vesting and Redemption of Silvercrest L.P. Interests”

In connection with our reorganization in 2013, the terms of the equity interests held by our named executive officers changed in several significant respects. As part of our reorganization, interests in Silvercrest L.P. were exchanged for Class B units of Silvercrest L.P. and shares of our Class B common stock. Class A units in Silvercrest L.P. are held by the Company, which serves as the general partner of Silvercrest L.P. Each Class A unit and Class B unit gives its holder the right to receive a percentage of the current profits of Silvercrest L.P. (as defined in the second amended and restated limited partnership agreement). Following our initial public offering, a substantial portion of the economic return of our principals has continued to be obtained through their equity ownership in Silvercrest L.P. We believe that the continued link between our performance and the economic return to our principals will encourage their continued exceptional performance. In addition, we believe that the restrictions on transfer and the ownership requirements to which our principals are subject serve to align our principals’ interests with those of our stockholders.

As an element of compensation, we intend to grant equity-based awards to those individuals considered to be important to our Company’s future success, primarily, (i) those professionals responsible for the investment performance of our strategies; (ii) those professionals principally responsible for servicing our existing clients and increasing our client base; and (iii) our executive officers.

At December 31, 2021, our Chief Executive Officer, Chief Financial Officer, General Counsel and Secretary and Managing Director – Institutional Business held restricted stock units with profits percentages and non-qualified stock options without profits percentages equity balances in Silvercrest L.P. as follows:

|

|

|

|

|

|

|

|

Equity |

|

|||

|

|

Profits |

|

|

2021 Earned |

|

|

Balance as of |

|

|||

|

|

Percentage (1) |

|

|

Profits (2) |

|

|

December 31, 2021 (3) |

|

|||

Richard R. Hough |

|

|

0.94 |

% |

|

$ |

99,730 |

|

|

$ |

4,246,336 |

|

Scott A. Gerard |

|

|

0.07 |

% |

|

$ |

7,311 |

|

|

$ |

185,161 |

|

David J. Campbell |

|

|

0.01 |

% |

|

$ |

1,323 |

|

|

$ |

30,854 |

|

J. Allen Gray |

|

|

0.12 |

% |

|

$ |

11,725 |

|

|

$ |

308,596 |

|

Tax Considerations

Prior to the Tax Cuts and Jobs Act of 2017 (the “Tax Act”), Section 162(m) of the Internal Revenue Code generally disallowed a tax deduction to a publicly-traded corporation for amounts paid in excess of $1 million to its chief executive officer and its three most highly compensated executive officers (other than the chief executive officer and the chief financial officer), unless the compensation plan and awards meet certain requirements qualifying the compensation as performance based compensation. The Tax Act made a number of changes to Section 162(m), including the repeal of the “qualified performance-based compensation” exemption and the expansion of the definition of “covered employees” (e.g., by including the chief financial officer as a covered employee). Transition rules under the Tax Act will allow certain payments to be deductible based on the pre-Tax Act rules if the payments are made pursuant to certain binding arrangements in effect as of November 2, 2017.

20

While the compensation committee cannot predict how the deductibility limit may impact our executive compensation program in future years, the compensation committee intends to maintain an approach to executive compensation that strongly links pay to performance. The compensation committee has not adopted a formal policy regarding tax deductibility of compensation paid to our executive officers but intends to continue to consider tax deductibility under Section 162(m) as a factor in compensation decisions to the extent Section 162 (m) is applicable. Notwithstanding the foregoing, we reserve the right to pay amounts that are not deductible under Section 162(m) during any period when Section 162(m) is applicable to us.

Policy on Hedging and Short Sales

The Company prohibits short sales and transactions in derivatives of Company securities for all directors and officers of the Company.

Risk Considerations in our Compensation Program

We do not believe that our compensation policies and practices motivate imprudent risk taking. Consequently, we are satisfied that any potential risks arising from our employee compensation policies and practices are not reasonably likely to have a material adverse effect on us. Our Compensation Committee, which is comprised entirely of independent directors, reviews our compensation plans and policies periodically to ensure proper alignment with overall company goals and objectives. Our Compensation Committee also reviews the risks arising from our compensation policies and practices and assesses whether any such risks are reasonably likely to have a material adverse effect on us.

Summary Compensation Table

The following table shows the annual compensation of our principal executive officer, principal financial officer and the three next most highly compensated executive officers who were serving as executive officers on December 31, 2021. These officers are referred to in this Proxy Statement as the “named executive officers.”

|

|

|

|

|

|

|

|

|

|

Stock |

|

|

All Other |

|

|

|

|

|||||

|

|

|

|

Salary |

|

|

Bonus |

|

|

Awards |

|

|

Compensation |

|

|

|

|

|||||

Name and Principal Position |

|

Year |

|

($) (1) |

|

|

($) (2) |

|

|

($) (3) |

|

|

($) (4) |

|

|

Total ($) |

|

|||||

Richard R. Hough, |

|

2021 |

|

$ |

700,000 |

|

|

$ |

1,000,000 |

|

|

$ |

1,623,449 |

|

|

$ |

— |

|

|

$ |

3,323,449 |

|

Chief Executive Officer and President |

|

2020 |

|

$ |

700,000 |

|

|

$ |

900,000 |

|

|

$ |

1,065,928 |

|

|

$ |

— |

|

|

$ |

2,665,928 |

|

|

|

2019 |

|

$ |

700,000 |

|

|

$ |

1,000,000 |

|

|

$ |

844,417 |

|

|

$ |

— |

|

|

$ |

2,544,417 |

|

Scott A. Gerard, |

|

2021 |

|

$ |

375,000 |

|

|

$ |

1,050,000 |

|

|

$ |

158,168 |

|

|

$ |

24,074 |

|

|

$ |

1,607,242 |

|

Chief Financial Officer |

|

2020 |

|

$ |

375,000 |

|

|

$ |

750,000 |

|

|

$ |

— |

|

|

$ |

21,053 |

|

|

$ |

1,146,053 |

|

|

|

2019 |

|

$ |

375,000 |

|

|

$ |

867,000 |

|

|

$ |

12,423 |

|

|

$ |

19,484 |

|

|

$ |

1,273,907 |

|

David J. Campbell, |

|

2021 |

|

$ |

375,000 |

|

|

$ |

793,265 |

|

|

$ |

26,375 |

|

|

$ |

— |

|

|

$ |

1,194,640 |

|

General Counsel and Secretary |

|

2020 |

|

$ |

375,000 |

|

|

$ |

696,150 |

|

|

$ |

— |

|

|

$ |

10,013 |

|

|

$ |

1,081,163 |

|

|

|

2019 |

|

$ |

375,000 |

|

|

$ |

696,150 |

|